Financial Reporting Questions and Answers

The development of an international financial reporting standard generally goes through a number of stages.

Which of the following is NOT a stage of development?

Country X levies a duty on alcoholic drinks. Where the alcohol content is above 40% by volume the duty levied is $5 per 1 litre bottle.

What type of tax is this duty?

Which of the following is NOT a feature of a multi-stage sales tax?

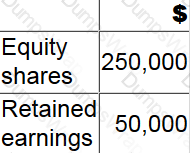

XY acquired 75% of the equity shares of CD on 1 January 20X2 for $230,000.

On 1 January 20X2 CD had the following balances:

XY uses the proportionate share of net assets method to value non controlling interest at acquisition.

Calculate the goodwill arising on the acquisition of CD.

Give your answer to nearest whole number.

LM is preparing its cash forecast for the next three months.

Which of the following items should be left out of its calculations?

Which of the following is NOT a source of short-term finance?

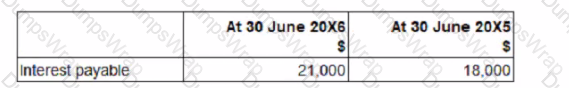

BCD's finance cost for the year ended 30 June 20X6 in its statement of profit or loss is $198,000. BCD's statement of financial position is as follows:

How much will be included in BCD's statement of cash flows for interest paid in the year ended 31 December 20X6?

Give your answer to The nearest $.

For an entity to be exempt from preparing consolidated financial statements it must meet certain criteria specified in IFRS 10 Consolidated Financial Statements.

Which of the following conditions would give exemption from preparing consolidated financial statements?

BC manufactures product X and on 1 February 20X4 started a project to develop a new material for use in its production. The development project is due to be completed by 31 December 20X4 with the new material being used in production from 1 January 20X5. The development project costs have been reliably estimated at $200,000 and it is anticipated that the new material will increase the margin achieved on product X by 20%.

You are a CIMA accountant within BC and are considering how to treat the development costs of $200,000 in the financial statements for the year ended 31 December 20X4.

In accordance with the ethical principle of professional competence and due care, which of the following statements correctly explains how these costs should be accounted for?

Company R use a defined benefit plan pension scheme. Employee UW has been working for Company R for 25 years. The defined benefit plan is 1.5% of the employee's annual salary during their time at the company,

for every year of employment.

Employee UW started on a £18,000 per annum salary. After 10 years of employment. Employee UW received a promotion and began earning £22,000. After another 3 years of employment. Employee UW got promoted

to a wage of £35,000, and is still on this salary now. How much pension has Employee UW accumulated since working at Company R?

According to IAS 21 The Effects of Changes in Foreign Exchange Rates, an entity should determine its functional currency.

Which of the following is NOT a factor that should be considered by an entity when determining its functional currency?

A specialized product was commissioned by a customer and the agreed price was $38,000. The product was completed at a cost of $34,000.

It was then discovered that new regulations meant that the specialized product now failed health and safety requirements. The specialized product had to be modified to meet the new regulations at a cost of $9,000. The customer agreed to pay an extra $3,000 towards the modifications.

At 31 December 20X5 the specialized product was still in inventory and had not been modified.

Calculate the value of the specialized product that should be included in inventory as at 31 December 20X5.

Give your answer to the nearest whole $000.

Which of the following is not a possible tax rate structure?

BBB has been experiencing liquidity problems and currently has an overdraft with the bank.

Which THREE of the following would be appropriate measures to help address this problem?

The tax rules in a country state that all tax returns must be filed by 31 March each year and that any outstanding tax balance must be paid by 14 April each year. An entity filed its tax return on 10 April 20X2 and paid the outstanding tax on 20 April 20X2.

Which TWO of the following powers is the tax authority likely to have in respect of these actions by the entity?

RS purchased an asset on 1 May 20X1 for $200,000, exclusive of import duties of $25,000.

The asset was sold on 1 December 20X3 for $450,000, incurring costs to sell of $15,000.

RS is resident in Country Y where indexation is allowable from the date of purchase to the date of sale.

The indexation factor increased by 40% in the period 1 May 20X1 to 1 December 20X3.

Capital gains are taxed at 25%.

What is the capital tax due from RS on disposal of the asset?

Which of the following is a feature of value added tax (VAT)?

GH's tax liability at 30 June 20X3 in respect of the tax charge on the profits for the year ended 30 June 20X3 is $876,000.

There was an over provision of $105,000 that related to the tax charge on the profits for the year ending 30 June 20X2.

What amount should be shown in GH's statement of profit or loss for the year ending 30 June 20X3?

Give your answer to the nearest $.

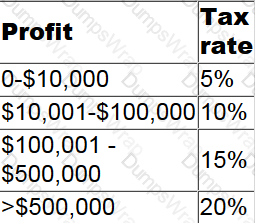

In Country X corporate income tax is levied on profits as follows:

Which of the following describes the tax rate structure in Country X?

Which of the following is an example of a progressive tax?

Which of the following would NOT be a risk or impact of overtrading?

Entity RH has an recognised a taxable profit of $1.Smillion for 20X1'. In Entity RH's resident country. Country M, depreciation charges and entertaining expenses are disallowed expenses. Below is some information on

Entitry RH's outgoings for the period:

Depreciation charged on PPE: $450,000

Political donations: $155,000

Staff parties: $3,200

Cost of updating assets: $10,000

Other expenses: $83,500

In Country M, there is a standard corporation tax of 12% charged on all corporation profits. What is Entity RH's total tax liability for this period?

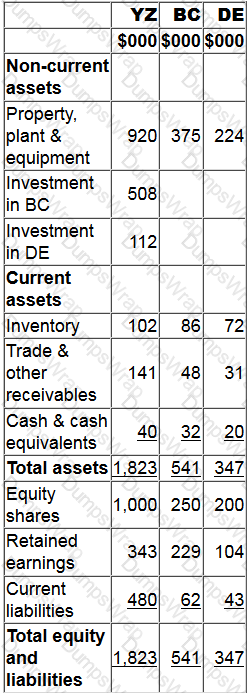

Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April 20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the value of inventory that will be included in YZ's consolidated statement of financial position at 31 March 20X2.

Give your answer to the nearest whole $.

MNO is a manufacturer. Which TWO of the following costs will MNO add to the cost of its finished goods inventory in accordance with IAS 2: Inventories?

An entity opens a new factory and receives a government grant of $25,000 towards the cost of new plant and equipment. This new plant and equipment originally costs $100,000.

The entity uses the net cost method allowed by IAS 20 Accounting for Government Grants and Disclosure of Government Assistance to record government grants of this nature. All plant and equipment is depreciated at 20% a year on a straight line basis.

Calculate the amount of depreciation to be included for this plant and equipment in the statement of profit of loss for the factory's first year of operation.

Give your answer to the nearest whole $.

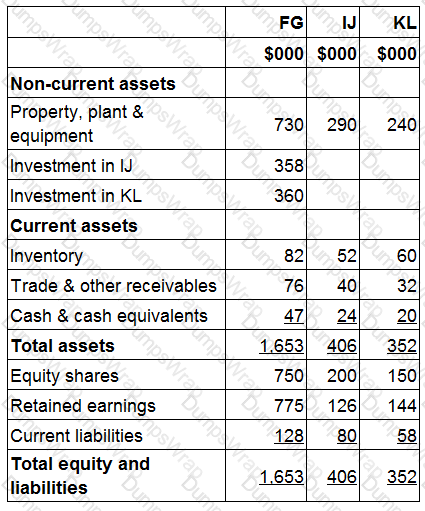

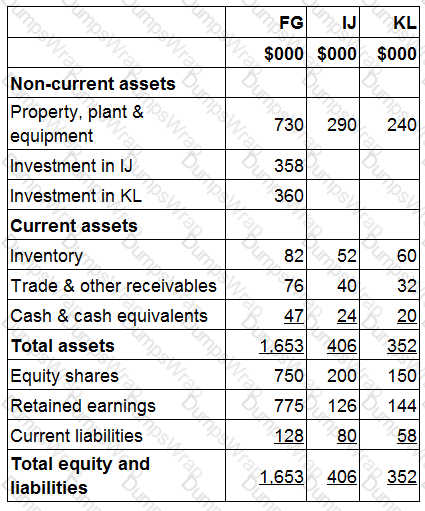

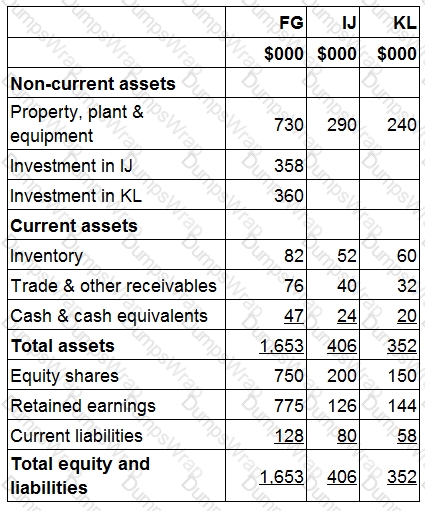

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were $98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the total goodwill to be included in FG's consolidated statement of financial position as at 31 December 20X5.

Give your answer to the nearest whole $.

Which of the following is NOT a type of supply for value added tax (VAT)?

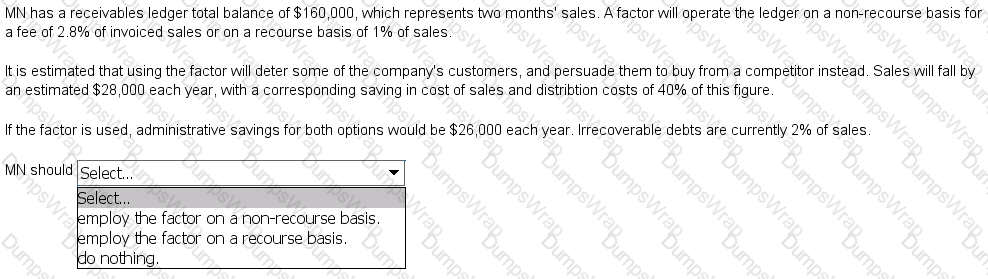

Which of the following is the most appropriate definition of the term 'factoring'?

XYZ operates in Country P where the tax rules state entertaining costs and accounting depreciation are disallowable for tax purposes.

In year ending 31 March 20X4, XYZ made an accounting profit of $240,000.

Profit included $14,500 of entertaining costs and $5,000 of income exempt from taxation.

XYZ has plant and machinery with accounting depreciation amounting to $26,300 and tax depreciation amounting to $35,200.

Calculate the taxable profit for the year ended 31 March 20X4.

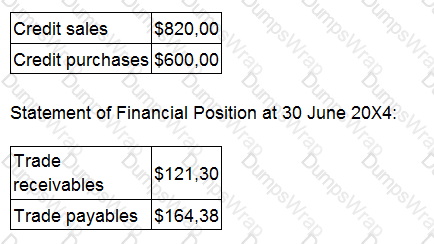

The following data relates to Company AB.

Statement of Profit or Loss for the year ended 30 June 20X4:

During the year ending 30 June 20X4, which was not a leap year, the average stock holding period was 102 days.

Calculate the working capital cycle in days.

Give your answer to the nearest full day.

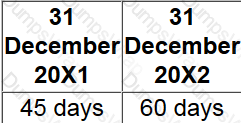

AB has been asked to analyze the receivables days of an entity with a view to improving the working capital cycle.

The following results have been produced for receivable days:

Which of the following is NOT an explanation of why the days have increased?

Which of the following is NOT a principle in the CIMA Code of Ethics for Professional Accountants?

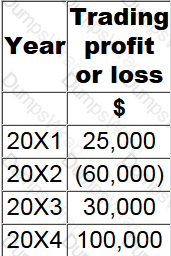

In Country X, trading losses in any year can be carried back and set off against trading profits in the previous year, with any unrelieved losses carried forward to set against the first available trade profits in future years.

GH had the following taxable profits and losses in years 20X1 to 20X4:

What are the taxable profits for 20X4, assuming the most efficient use of the loss is made?

Mr AM is the owner of Waxco Ltd. Mr AM was born in India, but currently resides in the USA. He has gained dual Indian and American citizenship.

Mr AM first registered Waxco Ltd in the USA when he started the company ten years ago. However, because of lower costs, the company moved its central management station to Germany two years ago. Waxco Ltd

has other smaller offices such as call centres across Asia, in locations such as Pakistan and Cambodia, however Waxco Ltd only currently sell goods in the USA.

Which of the countries mentioned are relevant for determining Waxco Ltd's competent jurisdiction?

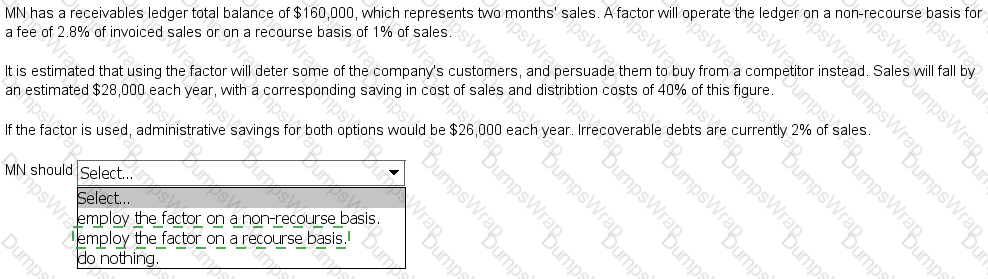

For the year ending 31 March 20X2, MN made an accounting profit of $120,000. Profit included $8,500 of political donations which are disallowable for tax purposes and $8,000 of income exempt from taxation.

MN has $15,000 of plant and machinery which was acquired on 1 April 20X0 and purchased a new machine costing $25,000 on 1 April 20X1. This new machine is entitled to first year allowances of 100% instead of the usual tax depreciation of 20% reducing balance. All plant and machinery is depreciated in the accounts at 10% on cost.

MN also has a building that cost $120,000 on 1 April 20X0 and is depreciated in the accounts at 4% on a straight line basis. Tax depreciation is calculated at 3% on a straight line basis.

Calculate the taxable profit.

Give your answer to the nearest $.

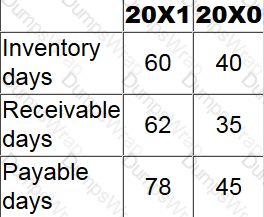

PZ has the following working capital ratios:

Which of the following could be the reason for the movements?

PP supplies zero-rated and standard-rated goods. During the year ended 30 March 20X3, the standard-rated goods made up 50% of the total supplies. During the year ended 30 March 20X4 this percentage increased to 60%.

What percentage of input tax suffered can PP claim back in the year ended 30 March 20X4?

Give your answer as a whole number.

In accordance with the Conceptual Framework for Financial Reporting, which TWO of the following qualitative characteristics of useful financial information should be considered when selecting a measurement basis?

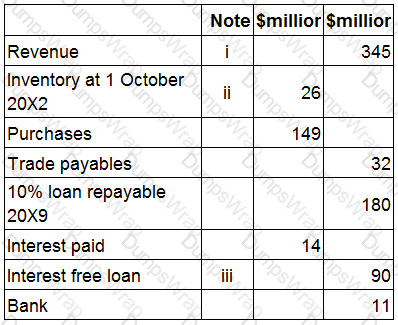

The following information is extracted from the trial balance of YY at 30 September 20X3.

i. Included in revenue is a refundable deposit of $20 million for a sales transaction that is due to take place on 14 October 20X3.

ii. The cost of closing inventory is $28 million, however, the net realisable value is estimated at $25 million.

iii. The interest free loan was obtained on 1 January 20X3. The loan is repayable in 12 quarterly installments starting on 31 March 20X3. All installments to date have been paid on time.

Calculate the cost of sales that would be shown in YY's statement of profit or loss for the year ended 30 September 20X3.

Give your answer to the nearest $ million.

ABC uses an aggressive approach to managing its working capital. XYZ uses a conservative approach to managing its working capital.

Which of the following is ABC more at risk of compared to XYZ?

CDO is an entity that is preparing to apply to its local stock market for a listing. CDO is currently run by a board of ten directors, each of whom manages a department of CDO. The board is chaired by Ms E who is also CDO's Chief Executive Officer.

Which TWO of the following actions would assist CDO to meet corporate governance regulations?

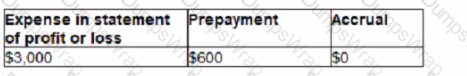

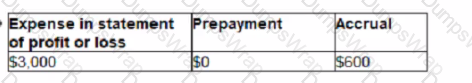

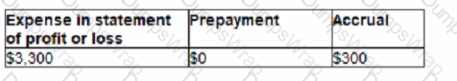

On 1 July 20X7, VWX enters into a 12-month lease for personal computers paying a non-refundable deposit of $600. Lease payments of $500 are paid monthly in arrears. VWX chooses to recognise the assets in the lease as short life and low value

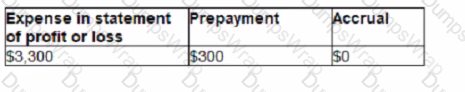

Which of the following gives the correct value for the expense in the statement of profit or loss and corresponding prepayment and accrual in VWX's statement of financial position for the year ended 31 December 20X7?

A

B

C

D

Which of the following is a feature of a direct tax?

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were $98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the amount of retained earnings that will be included in FG's consolidated statement of financial position as at 31 December 20X5.

Give your answer to the nearest whole $.

XY purchased a building on 1 April 20X1 for $300,000 with a useful economic life of 30 years. On 1 April 20X7 the building was revalued at $525,000.

What will the new depreciation charge be following the revaluation?

Give your answer as a whole number.

A building was purchased on 1 January 20X1 for $300,000 and had a useful economic life of 40 years. On 1 January 20X5 the building was revalued by a professional surveyor at $450,000. Directors decided to incorporate the revalued amount into the financial statements.

The accounting entries to record the initial revaluation of the building in the financial statements for the year ended 31 December 20X5 will be to debit building cost $150,000 and then:

On 1 January 20X2 an entity began work on constructing a factory. It purchased the land for $14 million, built the factory buildings for $11 million and installed plant and equipment for $7 million. The project was completed on 31 December 20X3 when the factory was deemed ready to use, however, the factory did not start operations until 1 June 20X4.

To fund the project the entity borrowed $25 million on 1 January 20X2, with interest at 10% per year.

The loan was repaid in full on 31 December 20X4.

Calculate the total amount to be added to the cost of property, plant and equipment in respect of the above development.

Give your answer to the nearest $ million.

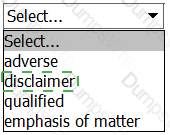

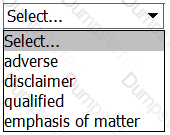

Whilst undertaking an external audit, the auditor has identified that there is insufficient evidence to support the financial statements.

As a result the auditors consider these financial statements to be wholly unreliable for decision making purposes.

This will result in a modified audit report with the opinion being .

An entity purchased an asset for $375,000 on 1 November 20X0 incurring legal fees of $33,000. Improvements were made to the asset for $65,000 on 1 December 20X2 which qualified as capital expenditure under the local tax rules. The entity also incurred repair costs on the asset on 1 February 20X3 amounting to $10,000.

The asset was sold for $680,000 on 1 December 20X5 incurring allowable costs on disposal of $15,000.

Indexation on the purchase cost and the improvement are allowable.

The index increased by 20% between November 20X0 and December 20X5,15% between December 20X2 and December 20X5 and 10% between February 20X3 and December 20X5

Calculate the chargeable gain on the disposal of the asset on 1 December 20X5.

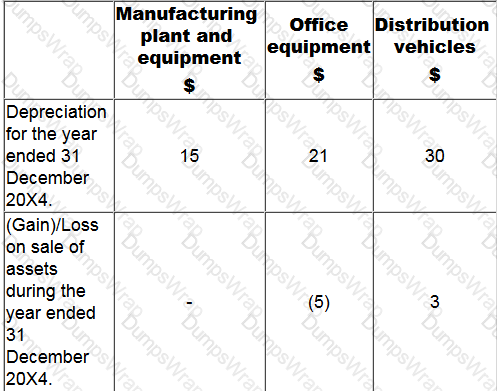

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered on the face of the Statement of profit or Loss for the year ended 31 December 20X4 in relation to Interest and Corporate income tax?

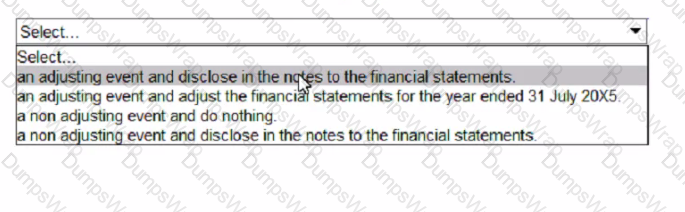

AB has prepared its financial statements for the year ended 31 July 20X5. On 15 September 20X5 a major fraud was uncovered by the external auditors which had taken place during the year to 31 July 20X5 The financial statements have not yet been authorised

In accordance with IAS 10 Events After the Reporting Period, AB should treat the fraud as:

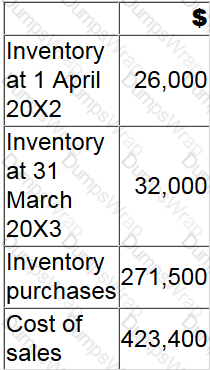

The following data has been extracted from GH's accounting records:

What is GH's average inventory days for the year ended 31 March 20X3?

In an entity's statement of profit or loss and other comprehensive income, which of the following would be presented as other comprehensive income?

An entity has a number of subsidiary and associate investments.

Which of the following must be disclosed in the entity's separate financial statements if it is exempt from presenting consolidated financial statements?

QR purchased a property for its investment potential on 1 January 20X3 for $2.5 million.

The total property cost is split as follows: land $1 million and buildings $1.5 million. The buildings were expected to have a remaining useful life of 40 years.

The local property index at 31 December 20X3 indicates that the fair value of the property has risen by 10%.

What is the balance that QR will include in its statement of financial position at 31 December 20X3 for this property, assuming that it uses the IAS 40 Investment Properties fair value model?

Give your answer in $million to two decimal places.

Which THREE of the following matters should an entity consider when determining the credit terms granted to a customer?

What does the exemption method of giving double taxation relief mean?

The external auditors have completed their audit and have discovered a material but not pervasive error in the financial statements of JK.

The directors of JK have refused to change the financial statements.

What type of modified audit report should be issued?

The following information relates to a single asset:

*Original cost of $186,000

*Estimated residual value of $6,000

*Expected useful life of 10 years

*Accumulated depreciation at 31 December 20X5 of $66,960

*Annual depreciation rate of 20% on a reducing balance basis

Calculate the amount of depreciation that should be charged to profit or loss for the year ended 31 December 20X6.

Give your answer to the nearest whole number.

Which of the following is the main purpose of corporate governance regulation?

The IV Group is formed of I Ltd and its subsidiary company V Ltd. I Ltd purchased 67% of V Ltd's ordinary share capital on 31 March 20X3.

The purchase cost I Ltd £129,000. At the date of purchase V Ltd's net assets were £155,000 while its share capital was £37,000. NCI fair value on the date of acquisition was £31,000.

What was the amount of goodwill I Ltd paid as part of the acquisition. Calculate this figure using both the proportion of net assets method and the full good will method for valuing the non-controlling interest.

What does the deduction method of giving double taxation relief mean?

Which THREE of the following are costs that a business might incur as a result of holding insufficient inventory of raw materials?

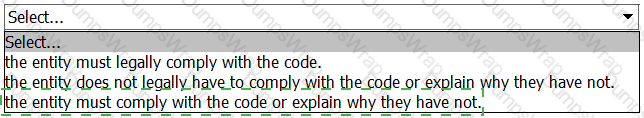

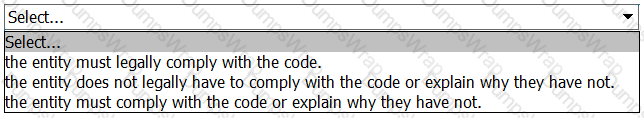

The United Kingdom (UK) uses a principle based approach to corporate governance which means:

OP is considering investing in government bonds. The current price of a $100 bond with 8 years to maturity is $88.

The bonds have a coupon rate of 6% and repay face value of $100 at the end of the 8 years.

Calculate the yield to maturity.

Give your answer to one decimal place.

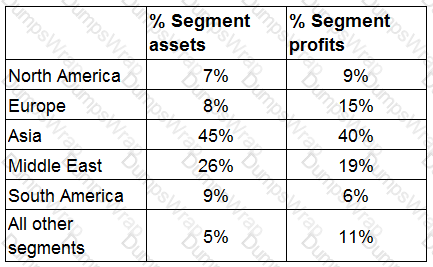

OP has five main geographic segments and reports segmental information in accordance with IFRS 8 Operating Segments.

Which THREE of the following would be regarded as operating segments of OP in accordance with IFRS 8?

What does the tax credit method of giving double taxation relief mean?

AA manufactures computers. These are sold to BB at $100 a computer plus a 5% sales tax. BB subsequently sells the computers to CC for $200 a computer plus a 5% sales tax. C sells the computers to customers at $300 a computer plus a 5% sales tax.

The total tax received by the tax authority is $30.

Which type of tax is described above?

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were $98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the value of property, plant and equipment to be recognized in FG's consolidated statement of financial position at 31 December 20X5.

Give your answer to the nearest whole $.

It costs PWR £7.50 to produce product H, per product. Product H is typically sold for £89.99. It costs £5.00 to package product H and £15 to deliver product H to customers.

PWR is currently selling faulty versions of product H from a defunct batch, (let's call this version product I), for 25% of the original price.

Which of the below options represent the correct inventory price for product I?

Which of the following is NOT a primary need for regulating financial reporting information of incorporated entities?

ST has $20,000 of plant and machinery which was acquired on 1 April 20X0. Tax depreciation rates on plant and machinery are 20% reducing balance. All plant and machinery was sold for $12,000 on 1 April 20X2.

Calculate the tax balancing allowance or charge on disposal for the year ended 31 March 20X3 and state the effect on the taxable profit.

Which of the following is a condition that has to be met for an entity to be exempt the requirement to prepare consolidated financial statements?