Financial Strategy Questions and Answers

A company based in the USA has a substantial fixed rate borrowing at an interest rate of 3.5% and wishes to swap a part of this to a floating rate to take advantage of reducing interest rates Its bank has quoted swap rates of 3 4%-3 5% against 12-month USD risk-free rate.

What is the overall interest rate achieved by the company under this borrowing plus swap combination?

A company has identified potential profitable investments that would require a total of S50 million capital expenditure over the next two years The following information is relevant.

• The company has 100 million shares in issue and has a market capitalisation of S500 million

• It has a target debt to equity ratio of 40% based on market values This ratio is currently 30%

• Earnings for the current year are expected to be S1 00 million

• Its last dividend payment was $1 per share One of the company's objectives is to increase dividends by at least 10% each year

• The company has no cash reserves

Which of the following is the most suitable method of financing to meet the company's requirements?

Which THREE of the following statements are disadvantages of the net asset basis of valuation?

A venture capitalist invests in a company by means of buying:

• 9 million shares for $2 a share and

• 8% bonds with a nominal value of $2 million, repayable at par in 3 years' time.

The venture capitalist expects a return on the equity portion of the investment of at least 20% a year on a compound basis over the first 3 years of the investment.

The company has 10 million shares in issue.

What is the minimum total equity value for the company in 3 years' time required to satisify the venture capitalist's expected return?

Give your answer to the nearest $ million.

$ million.

A company has accumulated a significant amount of excess cash which is not required for investment for the foreseeable future.

It is currently on deposit, earning negligible returns.

The Board of Directors is considering returning this excess cash to shareholders using a share repurchase programme.

The majority of shareholders are individuals with small shareholdings.

Which THREE of the following are advantages of the company undertaking a share repurchase programme?

Company A is subject to a takeover bid from Company B, both companies operate in the same industry and each of them demand a significant market share Company B h3S made an of an of $5 per share to the shareholders of Company A.

The directors of Company A do not believe the takeover would be in the best interests of the stakeholders and other stakeholders of Company A due to the following reruns

1. Company B has recently taken ever several ether companies resulting in them breaking up the company and se ling on the assets.

2 The directors of Company A believe the offer of $5 per snare undervalues tie company

The directors of Company A are therefore keen to prevent the bid from going ahead

Which THREE of the following defence strategies could be used by the directors of Company Air this situation?

A publicly funded school is focused on providing Value for Money

It pays its leaching staff less than other schools, because class sizes are generally smaller than elsewhere Despite some staff demotivation from low pay, exam pass rates are high given the close one-to-one attention many pupils receive.

On which aspect of Value for Money is the school underperforming?

A Venture Capital Fund currently holds a significant shareholding in a large private company as a result of funding a recent management buyout. It plans to exit this investment in 5 years time at a significant profit.

Which THREE of the following exit mechanisms are most likely to be preferred by the Venture Capital Fund?

A manufacturing company is based in Country L whose currency is the L$.

One of the company's products is exported to Country M, a rapidly growing economy, whose currency is the M$.

In the most recent financial year:

• 100,000 units of the product were sold to customers in country M

• The unit selling price was M$12

The spot rate today is L$1 = M$5

The company has an objective of growth in total sales value in L$ of 10% a year.

If the L$ strengthens by 5% next year against the M$, what volume of sales of this product is needed next year to achieve the objective?

Company M is a listed company in a highly technical service industry.

The directors are considering making a cash offer for the shares in Company Q, an unquoted company in the same industry.

Relevant data about Company Q:

• The company has seen consistent growth in earnings each year since it was founded 10 years ago.

• It has relatively few non-current assets.

• Many of the employees are leading experts in their field. A recent exercise suggested that the value of the company's human capital exceeded the value of its tangible assets.

The directors and major shareholders of Company Q have indicated willingness to sell the company.

Before negotiations become too advanced, the directors of Company M are considering the benefits to their company that would follow the acquisition.

Which THREE of the following are the most likely benefits of the acquisition to Company M's shareholders?

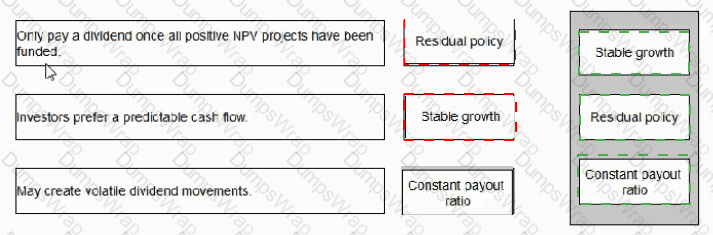

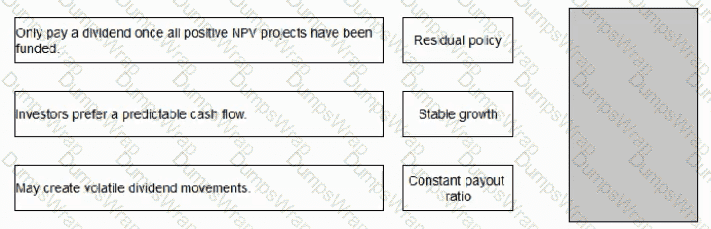

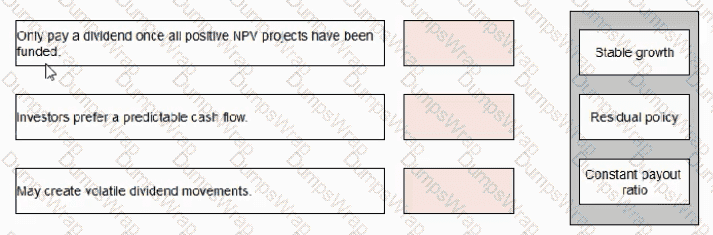

Select the most appropriate divided for each of the following statements:

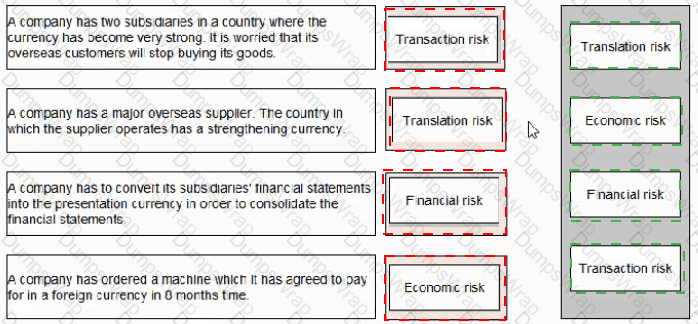

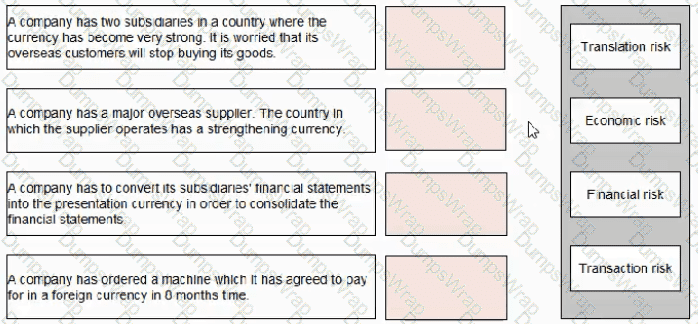

Select the category of risk for each of the descriptions below:

WW is a quoted manufacturing company. The Finance Director has addressed the shareholders during WW's annual general meeting-She has told the shareholders that WW raised equity during the year and used the funds to repay a large loan that was maturing, thereby reducing WW's gearing ratio

At the conclusion of the Finance Director's speech one of the shareholders complained that it had been foolish for WW to have used equity to repay debt The shareholder argued that the Modigliani and Miller model (with tax) offers proof that debt is cheaper than equity when companies pay tax on their profits.

Which THREE arguments could the Finance Director have used in response to the shareholder?

Which of the following would be a reason for a company to adopt a low dividend pay-out policy?

Company E is a listed company. Its directors are valuing a smaller listed company, Company F, as a possible acquisition.

The two companies operate in the same markets and have the same business risk.

Relevant data on the two companies is as follows:

Both companies are wholly equity financed and both pay corporate tax at 30%.

The directors of Company E believe they can "bootstrap" Company F's earnings to improve performance.

Calculate the maximum price that Company E should offer to Company F's shareholders to acquire the company.

Give your answer to the nearest $million.

A large multi-divisional company in the food processing and distribution business is conducting a strategic review. The divisions all compete in the same market.

The sale of one of its underperforming food processing divisions to the divisional management team is currently being considered. The purchase by the divisional management team will require venture capital finance.

Which THREE of the following are likely to influence the multi-divisional company's decision on whether or not to sell the under-performing division to the management team?

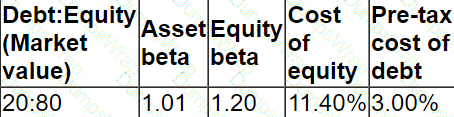

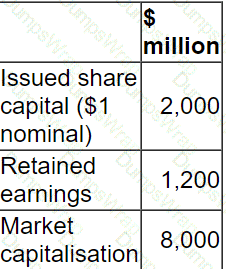

The following information relates to Company A's current capital structure:

Company A is considering a change in the capital structure that will increase gearing to 30:70 (Debt:Equity).

The risk -free rate is 3% and the return on the market portfolio is expected to be 10%.

The rate of corporate tax is 25%

Using the Capital Asset Pricing Model, calculate the cost of equity resulting from the proposed change to the capital structure.

A UK company enters into a 5 year borrowing with bank P at a floating rate of GBP Libor plus 3%

It simultaneously enters into an interest rate swap with bank Q at 4.5% fixed against GBP Libor plus 1.5%

What is the hedged borrowing rate, taking the borrowing and swap into account?

Give your answer to 1 decimal place.

On 31 October 20X3:

• A company expected to agree a foreign currency transaction in January 20X4 for settlement on 31 March 20X4.

• The company hedged the currency risk using a forward contract at nil cost for settlement on 31 March 20X4.

• The transaction was correctly treated as a cash flow hedge in accordance with IAS 39 Financial Instruments: Recognition and Measurement.

On 31 December 20X3, the financial year end, the fair value of the forward contract was $10,000 (asset).

How should the increase in the fair value of the forward contract be treated within the financial statements for the year ended 31 December 20X3?

Company Y plans to diversify into an activity where Company X has an equity beta of 1.6, a debt beta of zero and gearing of 50% (debt/debt plus equity).

The risk-free rate of return is 5% and the market portfolio is expected to return 10%.

The rate of corporate income tax is 30%.

What would be the risk-adjusted cost of equity if Company Y has 60% equity and 40% debt?

On 1 January 20X1, a company had:

• Cost of equity of 10 0%.

• Cost of debt of 5.0%

• Debt of $100Mmilion

• 100 million $1 shares trading at $4.00 each.

On 1 February 20X1:

• The company's share police fell to $3.00.

• Debt and the cost of debt remained unchanged

The company does not pay tax.

Under Modigliani and Miller's theory without lax. what is the best estimate of the movement in the cost of equity as a result of the fall in ne share price?

Which of the following statements about the tax impact on debt finance is correct?

A company enters into a floating rate borrowing with interest due every 12 months over the five year life of the borrowing.

At the same time, the company arranges an interest rate swap to swap the interest profile on the borrowing from floating to fixed rate.

These transactions are designated as a hedge for hedge accounting purposes under IAS 39 Financial Instruments: Recognition and Measurement.

Assuming the hedge is considered to be effective, how would the swap be accounted for 12 months later?

A company has 6 million shares in issue. Each share has a market value of $4.00.

$9 million is to be raised using a rights issue.

Two directors disagree on the discount to be offered when the new shares are issued.

• Director A proposes a discount of 25%

• Director B proposes a discount of 30%

Which THREE of the following statements are most likely to be correct?

A government is currently considering the privatisation of the national airline. The shares are to be offered to the public via a fixed price Initial Public Offering (IPO).

Which THREE of the following statements are correct?

A company is located in a single country. The company manufactures electrical goods for export and for sale in its home country. When exporting, it invoices in its customers' currency. What currency risks is the company exposed to?

Company ABD and Company BCD operate in the same industry and each has a significant market share.

The directors of Company ABD have heard rumours in the market that Company BCD is planning to bid to takeover Company ABD. They do not believe the takeover would be in the best interests of the shareholders and are therefore keen to prevent the bid from going ahead.

Which THREE of the following defense strategies could be used by the directors of Company ABD at this point in time?

A large, listed company is planning a major project that should greatly improve its share price in the long term.

These plans require a significant capital cost that the company plans to finance by debt.

All of the debt options being considered are for the same duration of time.

Which of the following sources of debt finance is likely to be the most expensive for the company over the full term of the debt?

ZZZ is a listed company based in Brinland. a European country. It is the largest owner and operator of residential care homes for elderly people in Brinland

Most of the residential care homes in Brinland are run by small private operators, and the standards of cafe are extremely variable However. 22Z has developed a good reputation because its client service is considered to be extremely good even though its prices are higher than those of most of its competitors.

ZZZ has expanded rapidly in the last few years, partly by acquisition and partly by organic growth consequently, the company's share price now stands at a record high, and the dividend declared at the end of the most recent accounting period was 10% higher than the previous year's dividend.

The Brinland government has recently set up a regulatory body to monitor the residential care homes industry. The regulatory body is considering introducing a variety of regulations to improve the customer experience in the industry. Following a period of consultation and investigation, the regulatory body is expected to announce a range of new regulations in the near future.

The directors of ZZZ are concerned that the new regulations may adversely affect their company

Which THREE of the following new regulations are likely to have the greatest negative impact on ZZTs performance?

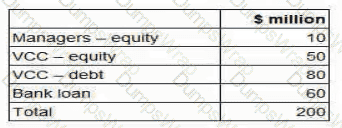

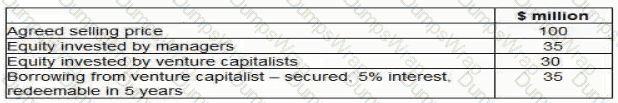

A company intends to sell one of its business units. Company W, by a management buyout (MBO). A selling price of S200 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal.

The VCC requires a minimum return on its equity investment In the MBO of 35% a year on a compound basis over 5 years. What is the minimum total equity value of Company W in 5 years time in order to meet the VCC's required return? Give your answer to one decimal place.

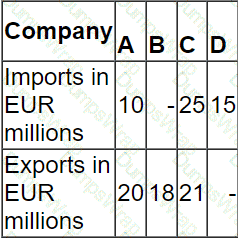

Companies A, B, C and D:

• are based in a country that uses the K$ as its currency.

• have an objective to grow operating profit year on year.

• have the same total levels of revenue and cost.

• trade with companies or individuals in the eurozone. All import and export trade with companies or individuals in the eurozone is priced in EUR.

Typical import/export trade for each company in a year are as follows:

Which company's growth objective is most sensitive to a movement in the EUR/K$ exchange rate?

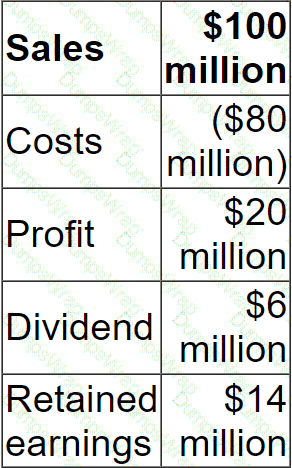

A company's main objective is to achieve an average growth in dividends of 10% a year.

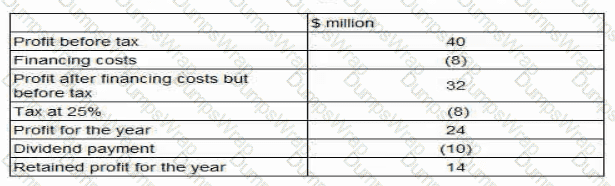

In the most recent financial year:

Sales are expected to grow at 8% a year over the next 5 years.

Costs are expected to grow at 5% a year over the next 5 years.

What is the minimum dividend payout ratio in 5 years' time that would allow the company to achieve its objective?

A company is currently all-equity financed with a cost of equity of 9%.

It plans to raise debt with a pre-tax cost of 3% in order to buy back equity shares.

After the buy-back, the debt-to-equity ratio at market values will be 1 to 2.

The corporate income tax rate is 25%.

Which of the following represents the company's cost of equity after the buy-back according to Modigliani and Miller's Theory of Capital Structure with taxes?

Which of the following statements are true with regard to interest rate swaps?

Select ALL that apply.

The Board of Directors of a listed company wish to estimate a reasonable valuation of the entire share capital of the company in the event of a takeover bid.

The company's current profit before taxation is $4.0 million.

The rate of corporate tax is 25%.

The average P/E multiple of listed companies in the same industry is 8 times current earnings.

The P/E multiple of recent takeovers in the same industry have ranged from 9 times to 10 times current earnings.

The average P/E multiple of the top 100 companies on the stock market is 15 times current earnings.

Advise the Board of Directors which of the following is a reasonable estimate of a range of values of the entire share capital in the event of a bid being made for the whole company?

A company based in Country D, whose currency is the D$, has an objective of maintaining an operating profit margin of at least 10% each year.

Relevant data:

• The company makes sales to Country E whose currency is the E$. It also makes sales to Country F whose currency is the F$.

• All purchases are from Country G whose currency is the G$.

• The settlement of all transactions is in the currency of the customer or supplier.

Which of the following changes would be most likely to help the company achieve its objective?

A company's Board of Directors wishes to determine a range of values for its equity.

The following information is available:

Estimated net asset values (total asset less total liabilities including borrowings):

• Net book value = $20 million

• Net realisable value = $25 million

• Free cash flows to equity = $3.5 million each year indefinitely, post-tax.

• Cost of equity = 10%

• Weighted Average Cost of Capital = 7%

Advise the Board on reasonable minimum and maximum values for the equity.

A company plans to cut its dividend but is concerned that the share price will fall. This demonstrates the _____________ effect

A company needs to raise $20 million to finance a project.

It has decided on a rights issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $5 per share.

Calculate the terms of the rights issue.

A company has two divisions.

A is the manufacturing division and supplies only to B, the retail division.

The Board of Directors has been approached by another company to acquire Division B as part of their retail expansion programme.

Division A will continue to supply to Division B as a retail customer as well as source and supply to other retail customers.

Which is the main risk faced by the company based on the above proposal?

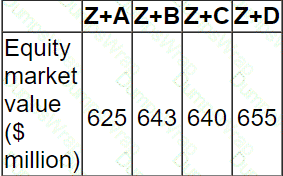

Company Z has identified four potential acquisition targets: companies A, B, C and D.

Company Z has a current equity market value of $580 million.

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?

CAPM:

E(R)=Rf+β(Rm−Rf)E(R) = R_f + \beta (R_m - R_f)E(R)=Rf+β(Rm−Rf)

Given:

E(R)=11%,Rf=2%,Rm=8%E(R) = 11\% , R_f = 2\%, R_m = 8\%E(R)=11%,Rf=2%,Rm=8%

0.11=0.02+β(0.08−0.02)⇒0.11−0.02=0.06β⇒0.09=0.06β⇒β=1.50.11 = 0.02 + \beta(0.08 - 0.02) \Rightarrow 0.11 - 0.02 = 0.06\beta \Rightarrow 0.09 = 0.06\beta \Rightarrow \beta = 1.50.11=0.02+β(0.08−0.02)⇒0.11−0.02=0.06β⇒0.09=0.06β⇒β=1.5

Beta > 1 ⇒ higher risk than the market.

Using the CAPM, the expected return for a company is 11%. The market return is 8% and the risk free rate is 2%.

What does the beta factor used in this calculation indicate about the risk of the company?

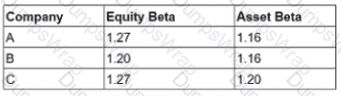

Three companies are quoted on the New York Stock Exchange. The following data applies:

Which of the following statements is TRUE?

An unlisted company wishes to obtain an estimated value for its shares in anticipation of a private sale of a large parcel of shares.

Relevant data for the unlisted company:

• It has a residual dividend policy.

• It has earnings that are highly sensitive to underlying economic conditions.

• It is a small business in a large industry where there are listed companies but there are none with a similar capital structure.

The company intends to base valuations on the cost of equity of a proxy company after adjusting for any differences in capital structure where appropriate.

Which of the following methods is likely to give the most accurate equity value for this unlisted company?

A company is considering the issue of a convertible bond compared to a straight bond issue (non-convertible bond).

Director A is concerned that issuing a convertible bond will upset the shareholders for the following reasons:

• it will dilute their control

• the interest payments will be higher therefore reducing liquidity

• it will increase the gearing ratio therefore increasing financial risk

Director B disagrees, and is preparing a board paper to promote the issue of the convertible bond rather than a non-convertible.

Advise the Director B which THREE of the following statements should be included in his board paper to promote the issue of the convertible bond?

A venture capitalist is most likely to take which THREE of the following exit routes?

A wholly equity financed company has the following objectives:

1. Increase in profit before interest and tax by at least 10% per year.

2. Maintain a dividend payout ratio of 40% of earnings per year.

Relevant data:

• There are 2 million shares in issue.

• Profit before interest and tax in the last financial year was $4 million.

• The corporate income tax rate is 20%.

At the beginning of the current financial year, the company raised long term debt of $2 million at 5% interest each year.

Calculate the dividend per share that will be announced this year assuming the company achieves its objective of increasing profit before interest and tax by 10%.

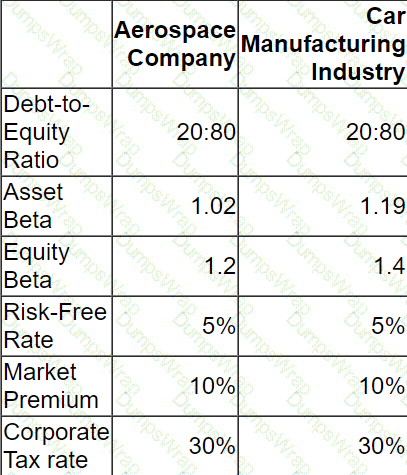

An aerospace company is planning to diversify into car manufacturing.

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.

A company is wholly equity funded. It has the following relevant data:

• Dividend just paid $4 million

• Dividend growth rate is constant at 5%

• The risk free rate is 4%

• The market premium is 7%

• The company's equity beta factor is 1.2

Calculate the value of the company using the Dividend Growth Model.

Give your answer in $ million to 2 decimal places.

$ ? million

Which of the following is NOT an advantage of a share repurchase?

Which THREE of the following methods of business valuation would give a valuation of the equity of an entity, rather than the value of the whole entity?

A company is considering whether to lease or buy an asset.

The following data applies:

• The bank will charge interest at 7.14% per annum

• The asset will cost $1 million

• Tax-allowable depreciation is available on a straight line basis over 5 years

• There is no residual value

• Corporate tax is paid at 30% in the year when the profit is earned

What is the NPV of the buy option?

Give your answer to the nearest $000.

$ ?

A listed entertainment and media company produces and distributes films globally. The company invests heavily in intellectual property in order to create the scope for future film projects. The company has five separate distribution companies, each managed as a separate business unit The company is seeking to sell one of its business units in a management buy-out (MBO) to enable it to raise finance for proposed new investments

The business unit managers have been in discussions with a bank and venture capitalists regarding the financing for the MBO The venture capitalists are only prepared to invest a mixture of debt and equity and have suggested the following:

The venture capitalists have stated that they expect a minimum return on their equity investment of 3Q°/o a year on a compound basis over the first 5 years of the MBO No dividends will be paid during this period.

Advise the MBO team of the total amount due to the venture capitalist over the 5-year period to satisfy their total minimum return?

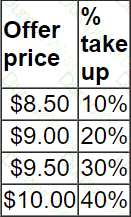

A listed company is planning a share repurchase.

Research into different offer prices has given the following data with regards acceptance by the shareholders at different prices:

What price should be offered to shareholders if the retained earnings of the company are to remain unchanged?

Clinic A provides free healthcare to all members of the community, funded by the central Government.

Clinic B provides healthcare which has to be paid for by the individual patients. It is a listed company, owned by a large number of shareholders.

In comparing the above two organisations and their objectives, which THREE of the following statements are correct?

A company raised fixed rate bank finance together with an interest rate swap for the same term and same principal value to pay floating receive fixed rate interest on an annual basis.

Which THREE of the following statements are correct?

An unlisted software development business is to be sold by its founders to a private equity house following the initial development of the software. The business has not yet made a profit but significant profits are expected for the next three years with only negligible profits thereafter. The business owns the freehold of the property from which it operates. However, it is the industry norm to lease property.

Which THREE of the following are limitations to the validity of using the Calculated Intangible Value (CIV) method for this business?

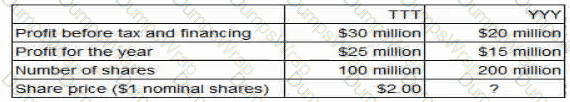

Two unlisted companies TTT and YYY are being valued. The companies have similar capital structures and risk profiles and operate in the same industry sector It is easier to value TTT than to value YYY because there have recently been several well-publicised private sales of TTT shares.

Relevant company data:

What is the best estimate of YYY's share price?

A listed company in a high growth industry, where innovation is a key driver of success has always operated a residual dividend policy, resulting in volatility in dividends due to periodic significant investments in research and development.

The company has recently come under pressure from some investors to change its dividend policy so that shareholders receive a consistent growing dividend. In addition, they suggested that the company should use more debt finance.

If the suggested change is made to the financial policies, which THREE of the following statements are true?

A company's current earnings before interest and taxation are $5 million.

These are expected to remain constant for the forseeable future.

The company has 10 million shares in issue which currently trade at $3.60.

It also has a $10 million long term floating rate loan.

The current interest rate on this loan is 5%.

The company pays tax at 20%.

The company expects interest rates to increase next year to 6% and it's Price/Earnings (P/E) ratio to move to 9.5 times by the end of next year.

What percentage reduction in the share price will occur by the end of next year if the interest rate increase and the P/E movement both occur?

A major energy company, GDE, generates and distributes electricity in country A. The government of country A is concerned about rising inflation and has imposed price controls on GDE, limiting the price it can charge per unit of electricity sold to both domestic and commercial customers. It is likely that price controls will continue for the foreseeable future.

The introduction of price controls is likely to reduce the profit for the current year from $3 billion to $1 billion.

The company has:

• Distributable reserves of $2 billion.

• Surplus cash at the start of the year of $1 billion.

• Plans to pay a total dividend of $1.5 billion in respect of the current year, representing a small annual increase as in previous years. However, no dividends have yet been announced.

Which THREE of the following responses would be MOST appropriate for GDE following the imposition of price controls?

D has US$10 million to invest over 12 months in either USS or GBP Its options are to invest in USS at the present USS interest rate of 10 18%. or to convert the USS to GBP at the spot rate GBP1 =US$1 61 and invest in GBP at an interest rate of 6.4%.

According to the interest rate parity theory, what will the one year forward rate be?

Give your answer to three decimal places.

Formed in 2010, the International Integrated Reporting Council The primary purpose of the IIRC's framework is to help enable an organisation to communicate which of the following'?

An unlisted company operates in a niche market, exploring the west coast of Africa for new oiI reservoirs.

The oil exploration program has been successful in recent years and t now has a substantial amount of oil reserves with a high level of certainty of being recoverable Under financial reporting regulations, oil still in the ground is not recognised as an asset unit is extracted.

The expense of the exploration program has used up all the company’s available cash resources.

The company has denied to list or a stock market and raise finds through an initial public offering to finance its drilling program.

Which of the following valuation methods in the appropriate to use in calculating an initial listing price for this company?

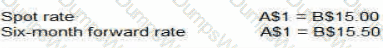

Company A operates in country A with the AS as its functional currency. Company A expects to receive BS500.000 in 6 months' time from a customer in Country B which uses the B$.

Company A intends to hedge the currency risk using a money market hedge

The following information is relevant:

What is the AS value of the BS expected receipt in 6 months' time under a money market hedge?

Company HJK is planning to bid for listed company BNM

Financial data for BNM for the financial year ended 31 December 20X1:

HJK is not forecasting any growth in these figures for the foreseeable future

Profit and cost data above should be assumed to be equivalent to cash flow data when answenng this question

Which THREE of the following approaches would be most appropriate for HJK to use to value the equity of BNM?

PYP is a listed courier company. It is looking to raise new finance to fit each of its delivery vans with new equipment to allow improved parcel tracking for customers The senior management team of PYP have decided on a 10-year secured bond to finance this investment-

Which TWO of the following variables are most likely to decrease the yield to maturity of the bond?

Integrated reporting is designed to make visible the capitals on which the organisation depends, and how the organisation uses those capitals to create value in the short, medium and long term

Which THREE of the following capitals are specifically identified in the Integrated Reporting

The Board of Directors of a listed company have decided that it needs to increase its equity capital to ensure it is in a more stable financial position.

The shareholder profile is a mix of institutional and individual small shareholders.

The board is considering either:

• A scrip dividend

• A zero dividend

Which THREE of the following would be considered disadvantages of a scrip dividend compared to a zero dividend?

A company plans to cut its dividend but is concerned that the share price will fall. This demonstrates the _____________ effect

A company is considering either exporting its product directly to customers in a foreign country or establishing a manufacturing subsidiary in that country.

The corporate tax rate in the company's own country is 20% and 25% tax depreciation allowances are available.

Which THREE of the following would be considered advantages of establishing the subsidiary in the foreign country?

A listed company has recently announced a profit warning.

The company's share price fell 20% on the day of the announcement but had been fairly static in the weeks leading up to the announcement.

Which form of efficient market is most likely to be indicated by this share price movement?

A company currently has a 5.25% fixed rate loan but it wishes to change the interest style of the loan to variable by using an interest rate swap directly with the bank.

The bank has quoted the following swap rate:

* 4.50% - 455% in exchange for Libor

Libor is currently 4%.

If the company enters into the swap and Libor remains at 4%. what will the company's interest cost be?

A company wishes to raise new finance using a rights issue to invest in a new project offering an IRR of 10%

The following data applies:

• There are currently 1 million shares in issue at a current market value of $4 each.

• The terms of the rights issue will be $3.50 for 1 new share for 5 existing shares.

• The company's WACC is currently 8%.

What is the yield-adjusted theoretical ex-rights price (TERP)?

Give your answer to 2 decimal places.

$ ?

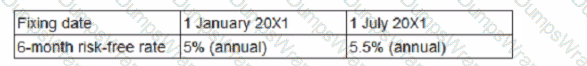

On 1 January 20X1 a company entered into a S200 million interest rate swap with a bank at a fixed rate of 4% against the 6-month risk-free rate to hedge the interest rale risk on a floating rate borrowing.

6-month risk-free rate was as follows:

What is the net settlement due under the swap contract on 1 July 20X1?

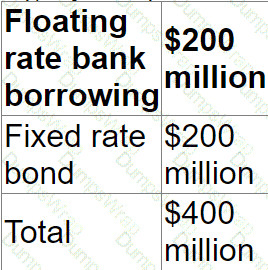

A company is in the process of issuing a 10 year $100 million bond and is considering using an interest rate swap to change the interest profile on some or all of the $100 million new finance.

The company has a target fixed versus floating rate debt profile of 1:1. Before issuing the bond its debt profile was as follows:

Which of the following is the most appropriate interest rate swap structure for the company?

A company is based in Country Y whose functional currency is Y$. It has an investment in Country Z whose functional currency is Z$.

This year the company expects to generate Z$ 10 million profit after tax.

Tax Regime:

• Corporate income tax rate in country Y is 50%

• Corporate income tax rate in country Z is 20%

• Full double tax relief is available

Assume an exchange rate of Y$ 1 = Z$ 5.

What is the expected profit after tax in Y$ if the Z$ profit is remitted to Country Y?

A venture capitalist has made an equity investment in a private company and is evaluating possible methods by which it can exit the investment over the next 3 years. The private company shareholders comprise the four original founders and the venture capitalist.

Advise the venture capitalist which THREE of the following methods will enable it to exit its equity investment?

A company's latest accounts show profit after tax of $20.0 million, after deducting interest of $5.0 million. The company expects earnings to grow at 5% per annum indefinitely.

The company has estimated its cost of equity at 12%, which is included in the company WACC of 10%.

Assuming that profit after tax is equivalent to cash flows, what is the value of the equity capital?

Give your answer to the nearest $ million.

$ ? million

A company is preparing an integrated report according to the International

Which THREE of the following should be included in the report?

Company A is a listed company that produces pottery goods which it sells throughout Europe. The pottery is then delivered to a network of self employed artists who are contracted to paint the pottery in their own homes. Finished goods are distributed by network of sales agents.The directors of Company A are now considering acquiring one or more smaller companies by means of vertical integration to improve profit margins.

Advise the Board of Company A which of the following acquisitions is most likely to achieve the stated aim of vertical integration?

A company has some 7% coupon bonds in issue and wishes to change its interest rate profile.

It has decided to do this by entering into a plain coupon interest rate swap with it's bank.

The bank has quoted a swap rate of: 6.0% - 6.5% fixed against LIBOR.

What will the company's new interest rate profile be?

A company with 4 million shares in issue wishes to raise $4 million by means of a rights issue

The share price prior to the rights issue is $5.00.

Under the rights issue, 1 million new shares will be issued at $4.00.

When the rights issue is announced it is expected that the Theoretical Ex-rights Price (TERP) will be $4.80

The directors of the company are considering offering any shareholder who does not wish to take up the rights the opportunity to sell the rights back to the company for $1.00.

Which of the following is the most likely consequence of the directors offer?

Which THREE of the following would be most important if a hospital wishes to review the effectiveness of its services?

Which THREE of the following statements are correct?

A venture capitalist invests in a company by means of buying:

• 9 million shares for $2 a share and

• 8% bonds with a nominal value of $2 million, repayable at par in 3 years' time.

The venture capitalist expects a return on the equity portion of the investment of at least 20% a year on a compound basis over the first 3 years of the investment.

The company has 10 million shares in issue.

What is the minimum total equity value for the company in 3 years' time required to satisify the venture capitalist's expected return?

Give your answer to the nearest $ million.

$ million.

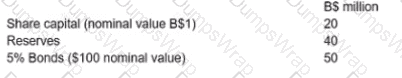

BBA is a wholly owned subsidiary of AAB BBA operates in country B where the currency is the B$.

The following is an extract from BBA's financial statements at 31 December 20X1:

The following Information is relevant:

" The bonds were trading at $110 per $100 on 31 December 20X1. "Operating profit of BBA for the year ended 31 December 20X1 was S15 million

• The P/E ratio is 8

* Corporate income tax rate is 20%.

The tax authorities m country B Implemented thin capitalisation rules based on the level of gearing of the subsidiary, calculated as book value o( debt lo book value of equity The cut-off point for gearing used by the tax authorities for a company to be thinly capitalised is 75%.

Which of the following statements is correct as at 31 December 20X1?

A company has:

• 10 million $1 ordinary shares in issue

• A current share price of $5.00 a share

• A WACC of 15%

The company holds $10 million in cash. No interest is earned on this cash.

It will invest this in a project with an expected NPV of $4 million.

In a semi-strong efficient stock market, which of the following is the most likely share price immediately after the announcement of the new investment?

A listed company is considering either a one-off special divided or a share repurchase scheme to reduce its surplus cash level.

Identify TWO advantages that a one-off special payment has over a share repurchase scheme.

Company A is based in country A with the AS as its functional currency. It expects to receive BS20 million from Company B in settlement of an export invoice.

The current exchange rate is A$1 =B$2 and the daily standard deviation of this exchange rate = 0 5%

What is the one-day 95% VaR in AS?

A project requires an initial outlay of $2 million which can be financed with either a bank loan or finance lease.

The company will be responsible for annual maintenance under either option.

The tax regime is:

• Tax depreciation allowances can be claimed on purchased assets.

• If leased using a finance lease, tax relief can be claimed on the interest element of the lease payments and also on the accounting depreciation charge.

The trainee management accountant has begun evaluating the lease versus buy decision and has produced the following data. He is not confident that all this information is relevant to this decision.

Using only the relevant data, which of the following is correct?

A company has borrowings of S5 million on which it pays interest at 8%. It has an operating profit margin of 20%.

The company plans to increase borrowings by S2 million Interest on additional borrowings would be 10% and the operating profit margin would remain unchanged

A debt covenant attached to the new borrowings requires interest cover to be at least 4 times throughout the period of the borrowing

Interest cover is defined in the loan documentation as being based on operating profit

What is the minimum sales value required each year to avoid a breach of the interest cover covenant'

Which THREE of the following are likely to be strategic reasons for a horizontal acquisition?

Company H is considering the valuation of an unlisted company which it hopes to acquire.

It has obtained the target company's financial statements.

Company H has been advised that the book value of net assets as shown in the financial statements of the target company does not provide a reliable indicator of their true value.

Advise the Board of Directors which of the following THREE statements are disadvantages of the net asset basis of valuation?

When valuing an unlisted company, a P/E ratio for a similar listed company may be used but adjustments to the P/E ratio may be necessary.

Which THREE of the following factors would justify a reduction in the proxy p/e ratio before use?

Extracts from a company's profit forecast for the next financial year as follows:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 1,250 million ordinary shares currently in issue and canceling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

A listed company is financed by debt and equity.

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

A company is valuing its equity prior to an initial public offering (IPO).

Relevant data:

• Earnings per share $1.00

• WACC is 8% and the cost of equity is 12%

• Dividend payout ratio 40%

• Dividend growth rate 2% in perpetuity

The current share price using the Dividend Valuation Model is closest to:

A company which is forecast to experience a strong growth in its profitability is evaluating a potential bond issue.

Which of the following changes in corporate income tax and in bond yields would make the bond issue more attractive to the company?

A company has stable earnings of S2 million and its shares are currently trading on a price earnings multiple {PIE) of 10 times. It has10 million shares in issue.

The company is raising S4 million debt finance to fund an expansion of its existing business which is forecast to increase annual earnings straight away by 25% and then remain at that level for the foreseeable future. The corporation tax rate is 20%. It is expected that the P/E will reduce to 8 times over the next year.

What is the most likely change in shareholder wealth resulting from this plan?

A private company manufactures goods for export, the goods are priced in foreign currency B$.

The company is partly owned by members of the founding family and partly by a venture capitalist who is helping to grow the business rapidly in preparation for a planned listing in three years' time.

The company therefore has significant long term exposure to the B$.

This exposure is hedged up to 24 months into the future based on highly probable forecast future revenue streams.

The company does not apply hedge accounting and this has led to high volatility in reported earnings.

Which of the following best explains why external consultants have recently advised the company to apply hedge accounting?

Company C has received an unwelcome takeover bid from Company P.

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

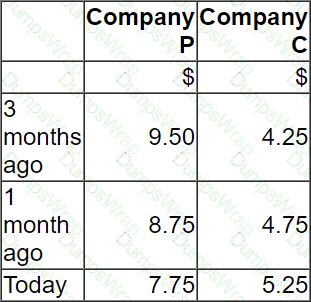

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

An unlisted software development company has recently reported disappointing results. This was partly due to weak economic conditions but also because of its poor competitive position. The company has a number of exciting development opportunities which would enable it to achieve significant future growth. The company's growth potential has been hindered by its inability to secure sufficient new finance.

To enable the company raise new finance the Directors are considering working forwards an IPO in 10 years and accepting finance from a venture capitalist in order support in the intervening period.

The directors are keen to retain a controlling stake in the company and full representation on the board. They therefore require venture capitalists to provide funds as a mix of debt and equity and not soley equity finance.

Which THREE of the following are most likely to disrupt the directors' plans to use venture capital finance?

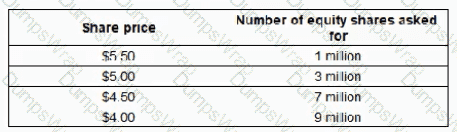

RST wishes to raise at least $40 million of new equity by issuing up to 10 million new equity shares at a minimum price of $3.00 under an offer for sale by tender. It receives the following tender offers:

What is the maximum amount that RST can raise by this share issue?

(Give your answer to the nearest $ million).

The Board of Directors of Company T is considering a rights issue to fund a new investment opportunity which has a zero NPV.

The Board of Directors wishes to explain to shareholders what the theoretical impact on their wealth will be as a result of different possible actions during the rights issue.

Which THREE of the following statements in respect of theoretical shareholder wealth are true?

A manufacturing company based in Country R. where the currency is the R$, has an objective of maintaining an operating profit margin of at least 10% each year

Relevant data:

• The company makes sales to Country S whose currency is the SS It also makes sales to Country T whose currency is the T$ " All purchases are from Country U whose currency is the US.

• The settlement of an transactions is in the currency of the customer or supplier

Which of the following changes would be most likely to help the company achieve its objective?

Company AAB is located in country A whose currency is the AS It has a subsidiary, BBA, located m country B that has the BS as its currency AAB has asked BBA to pay BS40 million surplus funds to AAB to assist with a planned new capital investment in country A The exchange rate today is AS1 = BS3

Tax regimes

• Company BBA pays withholding tax of 25% on all cash remitted to the parent company

• Company AAB pays tax of 10% on at cash received from its subsidiary

How much will company AAB have available for investment after receiving the surplus funds from BBA?

A company financed by equity and debt can be valued by discounting:

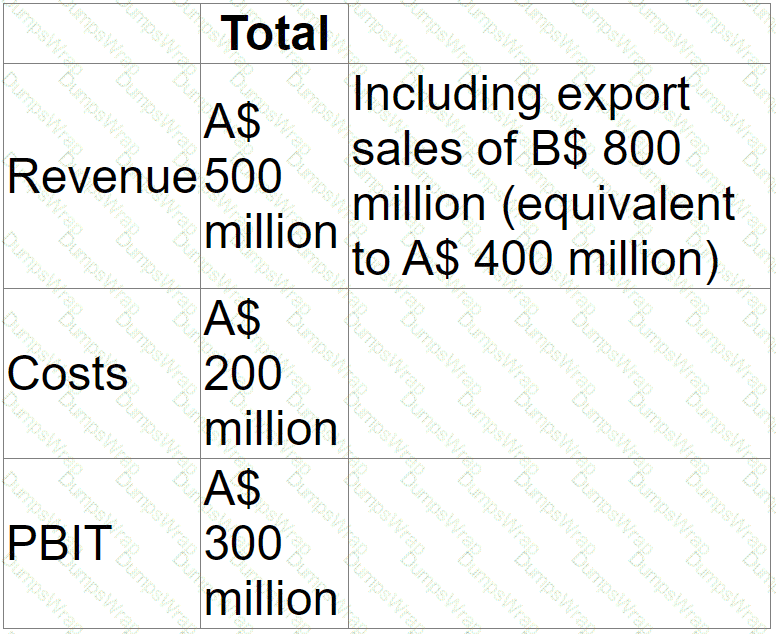

A company aims to increase profit before interest and tax (PBIT) each year.

The company reports in A$ but has significant export sales priced in B$.

All other transactions are priced in A$.

In 20X1, the company reported:

In 20X2, the only changes expected are:

• An increase in export prices of 10%, but no change to units sold.

• A rise in the value of the B$ to A$/B$ 2.500 (that is, A$ 1 = B$ 2.5)

Is it likely that the company would still meet its objective to grow PBIT between 20X1 and 20X2?

PPP's home currency is the PS. An overseas customer is due to make a payment of A$5,000,000 to PPP in 3 months. The present spot rate is 1PS = 5A$. P can obtain an interest rate of 4% per year on P$ deposits and 6% per year on AS deposits.

Forecast the value of the customer's payment to PPP, in PS, when the payment is made in 3 months' time.

Give your answer to the nearest thousand P$.

A company plans to acquire new machinery.

It has two financing options; buy outright using a bank loan, or a finance lease.

Which of the following is an advantage of a finance lease compared with a bank loan?

An unlisted company which is owned and managed by its original founders has accumulated excess cash following many years of profitable trading.

The Board of Directors is comprised of the four original founders who each hold 25% of the equity share capital.

Which THREE of the following will be significant considerations when deciding on the company's dividend policy?

A listed company is planning a share repurchase.

The following data applies:

• There are 10 million shares in issue

• The share repurchase will involve buying back 20% of the shares at a price of $0.75

• The company is holding $2 million cash

• Earnings for the current year ended are $2 million

The Directors are concerned about the impact that this repurchase programme will have on the company's cash balance and current year earnings per share (EPS) ratio.

Advise the directors which of the following statements is correct?

Which THREE of the following statements are true of a money market hedge?

A company's Board of Directors is assessing the likely impact of financing new projects by using either debt or equity finance.

The impact of using debt or equity finance on some key variables is uncertain.

Which THREE of the following statements are true?

Company RRR is a well-established, unlisted, road freight company.

In recent years RRR has come under pressure to improve its customer service and has had some success in doing this However, the cost of improved service levels has resulted in it making small losses in its latest financial year. This is the first time RRR has not been profitable.

RRR uses a 'residual' dividend policy and has paid dividends twice in the last 10 years.

Which of the following methods would be most appropriate for valuing RRR?