Investment Funds in Canada (IFC) Exam Questions and Answers

What does relative performance seek to compare between a fund and the other funds in its category?

Ayan wants to make a registered retirement savings plan (RRSP) contribution and deduct it from his Year 1 income. What is the deadline for this contribution (assume that it is NOT a leap year)?

Davis invested in a tactical asset allocation fund in his non-registered investment account. Distributions from the mutual fund are paid directly to Davis and not reinvested. Assuming a federal marginal tax rate

of 26%, dividend gross-up rate of 38% and federal dividend tax credit rate of 15%, which type of distribution would result in the lowest amount of tax payable?

Jeremy is reviewing the prospectus of a Canadian equity fund and notes the fund permits the use of derivatives. The stated objective of the derivative use is bet on the future movement of the market to increase the fund's returns. What should Jeremy be aware of regarding this fund?

Which of the following statements about nominee name accounts is TRUE?

How does the life-cycle hypothesis assist an advisor while interacting with clients?

Who has the ultimate responsibility for the activities of a mutual fund corporation?

Frederic recently sold his units in a US dollar (USD) denominated mutual fund. He wants to convert the proceeds back to Canadian dollars (CAD). If he received proceeds of $1,200 USD from the sale and the exchange rate is $1 CAD for $0.99 USD, how much will Frederic receive in Canadian dollars?

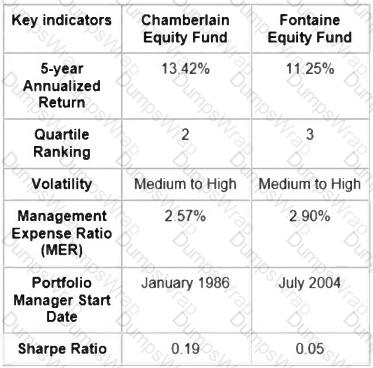

You have been researching Canadian equity mutual funds for a new client. You come across the following information.

What can you conclude from this information?

What information does Fund Facts provide to potential investors?

Sonya meets with her client Elijah to review different investment approaches that could be offered to help him reach his financial goals. Part of that discussion included Sonya mentioning factors such as

inflation, interest rates, and rates of return. Which stage of the Strategic Investment Planning (SIP) process does this describe?

Jasmine received an inheritance from her grandmother of $10,000. She wants to invest her money wisely. She has seen in the news that a particular energy company is doing very well and has good prospects. She has also seen how volatile its share price has been in the last year. She knows the risks of the resource sector and wants to invest but is not comfortable with so much volatility. Which of the following mutual fund benefits would address her concern?

Last year, a hedge fund had a gross return of 22%. The hurdle rate was 5%, and the incentive fee was 20%. What percentage compensation would the fund manager earn for this strategy, assuming no other fees exist?

Which of the following CORRECTLY describes a material conflict of interest that has been properly addressed by the Dealing Representative?

Nancy received a $160 taxable dividend from Can-Star Ltd., whose shares she holds in her non-registered account. Can-Star is a taxable Canadian corporation. What is the approximate amount of the dividend tax credit Nancy will receive on the shares?

What areas are addressed in the Client Relationship Model (CRM) regulation?

Preston has been working for Thompson Industries for just over a year and has been part of Thompson's deferred profit sharing plan (DPSP) program from his start date. Preston wants to know more about

these types of plans.

What would you tell Preston about DPSPs?

Which information is typically included in the Letter of Engagement?

You are collecting know your client (KYC) information for your new client, Yael. She has recently accepted an early retirement package from her employer and has $100,000 to invest. She is looking for an investment that will provide income to help pay her ongoing monthly expenses. Without this extra income, she would have trouble paying her bills. From your discussions, Yael understands that markets fluctuate and says she is comfortable with high risk. Which of the following would be a suitable investment?

Bernadette has a high-paying job and is in the top tax bracket. She recently received a payment of $5 million upon the settlement of her uncle's estate. Bernadette would like to invest her inheritance in financial products that would not only grow her money but is also income tax friendly.

Which of the following would provide the most favourable tax treatment?

Which exemplifies the tendency of mutual fund companies to shut down poor performing funds?

Sagira is a Compliance Officer with WealthPath Investments Inc., a registered mutual fund dealer. Sagira routinely answers inquiries from the firm's Dealing Representatives and offers guidance.

Which of the following statements would Sagira likely agree is a permitted activity for Dealing Representatives to have with clients?

Which statement best describes key differences between dividend funds and standard equity funds?

You are meeting a potential client, William, for the first time. He is a high net worth individual and you are keen to get his business. Which of the following would you consider the most important to create an impressive first impression on your potential client?

Ai Fen has recently become registered to sell mutual funds with Acadian Eastern Financial, a mutual fund dealer. Ai Fen determined that with her background of being a Chartered Financial Analyst, she can help people understand the nature of investing more easily than others in her field.

Which registration category will need to be prominently noted on Ai Fen’s business card to comply with the “holding out rule”?

Fernanda, an advisor, is setting up her process for completing client suitability assessments. What must Fernanda do with respect to investment suitability?a

A portfolio that incurs a substantial loss due to a significant downturn in Canadian equities has been exposed to what type of risk?

Which newspaper article would be likely to result in foreign capital moving out of a country?

Which money market fund yield is calculated as the most recent seven-day yield?

Portia is a Dealing Representative with Highview Wealth Inc., a mutual fund dealer. Portia recommends the Stature Growth Fund to her client Clive. Which of the following CORRECTLY describes what Portia must do in order to satisfy her obligations under the Client Relationship Model (CRM) and Client Focused Reforms (CFR)?

Sandra presently participates in her employer-sponsored defined contribution pension plan (DCPP). As contributions continue to be made into her plan, what can she expect?

What is a characteristic of joint investment accounts?

Manuel is a Dealing Representative for Commonwealth Financial Inc., a mutual fund dealer. His dealer represents many different mutual fund families available, including their own: CF Group of Funds. He is

considering recommending a CF equity fund to one of his clients, Stefania. While describing details about the fund, he informs her that accounts are set-up in nominee name, and that their mutual funds are not transferable. In addition, the fund does pay trailer fees.

What type of information has Manuel described about his potential investment recommendation?

Ken is a member of his employer’s Defined Benefit Pension Plan (DBPP). Which of the following statements about Ken’s plan is CORRECT?

In which of the following situations would the client mobility exemption apply?

The XYZ Canadian Equity Income fund is classified as a large cap Canadian equity fund. Despite overall growth in the Canadian equity markets over the last several years, the fund has underperformed its peer group. What is one possible explanation for the underperformance?

On January 3, John invests $500 in the Blue Sky U.S. Equity Fund. On July 1 of the same year, he invests another $500 into the same mutual fund. Information about the net asset value per unit (NAVPU) at the time of each transaction is provided below. Given this information, what will be the value of John's investment on December 31 of this year (please ignore transaction costs and distributions)?

Pacari is a Dealing Representative with Cavalry Investments, a mutual fund dealer. Pacari’s client, Darsha, is a long-time customer and an elderly widow. Darsha depended on her husband, for financial decisions before he passed. Pacari has also noticed that Darsha’s capacity seems to be declining over the years. Luckily, with Pacari’s help, Darsha has been managing her finances well. However, Darsha’s daughter has been getting involved recently and has even tried to enter trades without Darsha’s authorization. Pacari is particularly concerned about the last transaction for Darsha’s account: a very large redemption. Pacari fears that Darsha has become a victim of financial exploitation and he raises his concerns with his dealer Cavalry. Which of the following statements about how Cavalry may proceed is CORRECT?

Sonya, a mutual fund manager for Drake Financial, has had a stellar year in managing their Canadian equity portfolio and has outperformed the benchmark by over 200 basis points. She is now concerned that within the last couple of months of this calendar year, the Canadian equity market is due for a 10 to 15% pullback. Which investment strategy would be most appropriate for her to implement for the last couple of months of the year to offset the market correction?

You are comparing the performance of ABC Equity Fund and XYZ Equity Fund to their benchmark. Indicate the correct statement.

Return | Year 1 | Year 2 | Year 3 | 3 Year Compound Return

Benchmark | -2.0% | 12.6% | 20.6% | 10.0%

ABC Equity Fund | -10.0% | 16.0% | 24.0% | 9.0%

XYZ Equity Fund | 8.0% | 9.0% | 10.0% | 9.0%

Sylvia decided to use the savings from her bank account to purchase a 5-year bond. The face value of the bond is $10,000, the market price is $9,230 and the coupon rate is 7%.

What is the current yield on the bond? Round to 2 decimal places.

What bias would be considered an emotional behavioural bias?

What activity is expected of mutual funds registrants?

Darryl has a diversified investment portfolio of mutual funds in a non-registered account with Investwell Mutual Funds, a mutual fund dealer. Darryl’s diversified portfolio is composed of 3 mutual funds. Each mutual fund is currently worth about $100,000. The ABC Canadian Equity Fund has a total return of 6%, the DEF Bond Fund has a total return of 8% and GHI Global Equity Fund has a total return of 10%. Darryl wants to make an in-kind contribution to his registered retirement savings plan (RRSP) account. He has unused RRSP contribution room of $60,000.

From a tax-efficient viewpoint, which funds contribute in-kind to his RRSP account?

What term applies to unemployment created by a new technology that eliminates the need for subway train drivers?

Which client has demonstrated the endowment behavioural bias?

Which of the following statements about your mutual fund registration is CORRECT?

How might a registrant provide beneficial mutual fund advice and service?

What is the process of selecting specific industries from which stocks will be chosen for the portfolio?

A client wishes to deal with one registered representative for both banking services and mutual fund investments. The client would also like advice on determining where best to place their money to enhance their overall tax situation as they approach buying a home. Which individual is best suited for this service if the client's goal is to build a long-term advisor-client relationship?

What items are typically classified as current assets on the statement of financial position?

An investor wishes to add another security to his portfolio. He is looking at a stock that has a correlation with the portfolio of 0.99. What should the advisor tell this investor?

Which of the following statements is TRUE about inflation?

Your client earns $100,000 from employment and $10,000 from investments each year. Her bills total $95,000 annually. What is her discretionary income?

Jenny contributed $5,000 each year for five years to a spousal RRSP in Albert's name. In the sixth calendar year, Jenny did not contribute and Albert withdrew all the funds from the spousal RRSP. What are the tax implications of the withdrawal for Albert and Jenny?

What statement shows a company’s position at a specific date?

A mutual fund sales representative is under pressure to meet certain sales objectives. However, he consistently ignores these quotas when making client recommendations. Which standard of conduct has he followed?

Which organization regulates mutual and investment funds?

What is a requirement when holding an RRIF?

Based on return and performance, which fund should be recommended?

Rashad is a Dealing Representative with Investors Network Corp., a mutual fund dealer. Investors Network is registered in all provinces and territories of Canada and Rashad is registered in the Edmonton,

Alberta branch. Rashad is told to provide his Branch Manager with a number of client files. The client files will be part of a compliance review by the applicable self-regulatory organization (SRO). Which

regulator will review Rashad's client files?

Raybert has a very short-term investment objective and has decided to purchase money market instruments. There are plenty of 90-day money market securities available for him to choose from. Although Raybert is aware that all the respective issuers have a similar need for his capital, no matter what he decides, he can only afford to purchase one.

In terms of financial markets and their relationship to the principles of supply and demand, which characteristic of investment capital are the issuers being exposed to?

Irina Pluskova is a financial advisor for a multi-national firm. She is a well-known personality within the local community for her philanthropic work with children's charities. What must Irina do to uphold the Standards of Conduct?

What may be used to determine which of two bond portfolios is more sensitive to interest rate changes?

Suzie received a T3 for investment income earned on her investment in DEW Canadian Balanced Fund. In what account type is this investment held?

Barend is a Dealing Representative with Planvest Group Inc., a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA). Which of the following CORRECTLY describes

Barend's obligation for conflicts of interest?

Your soon-to-be-retired client has accumulated $700,000 in a mutual fund investment. He has consulted with you with respect to systematic withdrawal plans. His other sources of income in retirement are uncertain. He is not interested in leaving a legacy at his death. Which plan would best suit his needs?

You are meeting a new client, Steven, and you are trying to determine his level of understanding of different investments. Which question would give you the most information regarding your client's familiarity with investing?

Taylor is chatting with other parents in the park when the conversation turns to registered education savings plans (RESPs). Taylor thinks that most of what they are saying is incorrect. Which of the following

statements about self-directed RESPs is TRUE?

Sachin owns units of a long-term bond fund. He has heard that the Bank of Canada is likely to make it more expensive to borrow money. He is worried that the value of his investment is going to drop. What sort of investing risk is Sachin experiencing?

Eleanora receives a $500 eligible Canadian dividend from her mutual fund. Her federal marginal tax rate for the year is 29%. Assuming the enhanced gross-up of 38% and a federal dividend tax credit of 15.02%, how much federal tax will she pay on her dividend?

Gary chooses not to recommend that his client sell a current mutual fund to purchase a similar new mutual fund despite pressure to meet a sales target for the new fund. What responsibility applies to Gary’s action?

Loretta is looking for a well diversified equity fund. Her ideal mutual fund would hold investments within and outside Canada. Although she is seeking growth, Loretta also wants a mutual fund that invests in quality companies.

Which of the following mutual funds would be the best choice for Loretta?

Which of the following asset allocation statements is correct?

One of your clients, Rakesh, had a portfolio composed of 60% ABC Equity Fund and 40% ABC Bond Fund. Since equities were performing much better than fixed income, he had increased his holdings in ABC Equity Fund to 70% and had reduced his holding in ABC Bond Fund to 30% of his portfolio.

After benefitting the growth in his ABC Equity Fund for over 2 years, Rakesh is uncomfortable with this heavy exposure to equity funds and decides to rebalance his portfolio back to 60% of ABC Equity Fund and 40% of ABC Bond Fund.

He instructs you to switch 10% of the portfolio from the ABC Equity Fund to the ABC Bond Fund.

Which of the following statements is CORRECT?

Which statement about market risk is true?

Pierre buys a call option on a stock. What is the implication of this transaction?

Armand, a financial advisor, recently met with Austin, a potential client. Austin is interested in a conservative portfolio that focuses on mature companies that are out of favour with a low turnover. What is the best investment philosophy for Austin?

Sarah and Kyle are a married couple. They are both 34 years of age and work as teachers. Their combined annual income is $130,000. They are able to save $800 each month. They own a home worth $340,000 with a $120,000 mortgage. Since they work for the same employer, they have the same defined benefit pension plan. Other than a tax-free savings account (TFSA) in Kyle’s name with $5,000, they do not have any other assets.

They are avid sailors and want to save towards a purchase of a sailboat. For the type of sailboat they want, they estimate it should cost around $65,000. They want you to recommend an investment for their monthly savings to help them achieve their goal faster.

What question should you ask them next?

What do Guaranteed Income Supplement (GIS) and Allowance for the Survivor have in common?

You are the portfolio manager for the ABC asset allocation fund. Interest rates are going up; the stock market has been very volatile recently and is forecast to continue that way for the next two quarters. What changes, if any, will you make to your current asset allocation of 50% bonds and 50% equities?

Zara buys a future contract with an underlying value of $100,000 worth of stocks. She is required to deposit $1,750 of margin. Two weeks later, the underlying value of the stocks is $101,900. What is Zara's total return?

What type of fee is used to compensate mutual fund sales representatives for providing ongoing services to clients?

Faruq is a Dealing Representative with Smart Planning Group, a mutual fund dealer. Faruq meets with his new client, Taline, and learns that she lives on a low, fixed income.

Taline tells Faruq that she wants to maximize her investment returns as high as possible to make up the difference. Taline also indicates that she cannot afford large investment losses because her income is low. Which of the following CORRECTLY describes how Faruq should assess Taline’s risk profile?

Which financial instruments trade primarily in an auction market?

What type of benefit plan has a final benefit that is dependent on the investment returns within the plan?

When reviewing a company's balance sheets, what ratio best determines whether their borrowing is excessive?

What is the current yield on a $5,000 Government of Canada bond paying a 6% coupon and trading at a price of $102 (rounding to the nearest hundredth)?

Jabir begins the registration process with his new dealer Prosper Wealth Inc. Jabir is excited about his new career and eager to start calling clients, opening new accounts, and selling investments. Which of the following CORRECTLY describes when Jabir will be eligible to open new client accounts and sell investments?

For the last year, an investor earned a return before adjustment for inflation of 2% on a money market fund, while inflation averaged 1.5%. What was his nominal rate of return?

Louis is the portfolio manager for Quattro Fund. The mandate of the mutual fund is to invest in a combination of cash, fixed income, and equity securities; however, Louis has the ability to adjust the portfolio according to market conditions. If Louis feels that interest rates will fall, he could invest the whole portfolio in equities. If he feels the market is too high, he could take profits and sit totally in cash. What type of mutual fund is Quattro Fund?

A married couple is opening a spousal RRSP account in the name of the wife. The dealing representative gathers the information required on the NAAF, including the wife’s name, social insurance number, permanent address, and investment objectives. The representative also gathers KYC information for both and informs them that leveraging is not permitted with respect to RRSP accounts. Which information was not required?

What type of risk remains unaffected by diversification?

You ask a new client, Brad, "what are your financial obligations and what are your assets?" What information are you trying to gather in order to comply with the know your client (KYC) rule?

Which conduct standard addresses personal financial dealings with clients?

What is an example of a direct investment?

What response would a loss-averse investor be most likely to choose in selecting a preferred investment return scenario?

Which of the following is included when calculating a country's gross domestic product (GDP)?

Sujay contributes 3% of his $60,000 salary to his employer’s defined contribution pension plan. His employer contributes the same amount to the plan. How will this affect his registered retirement savings plan (RRSP) contribution room for the year?

What is the first step before becoming eligible for registration as a mutual fund dealing representative?

Lucas wants to participate in the Lifelong Learning Program (LLP). He currently has $10,000 in his registered retirement savings plan (RRSP) for this purpose. He plans to make his maximum permitted

withdrawal of $10,000 under the LLP in two months. Based on this information, what would be his investment objective for the $10,000 currently sitting in his RRSP?

On January 2nd of this year Evan purchased 500 preferred shares of Ingram Ltd. The preferred shares have a par value of $25 per share and a quarterly dividend of $0.98 per share. They also give Evan the option to sell the shares back to Ingram at par value any time from now until September 1st two years from now. What type of preferred shares does Evan own?

Douglas, aged 73, won a lottery prize of $100,000 last week. Today he contacted Vincent, his Dealing Representative, with instructions to contribute the winnings to his registered retirement income fund (RRIF) account.

Which of the following statement about RRIF is CORRECT?

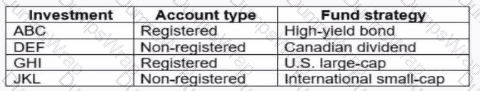

Matthew is planning on making the following investments in December:

Assuming all four investments have performed well throughout the year, which investment will trigger the highest unexpected taxes?

What equity investment philosophy places greater emphasis on industry weighting than on security selection?

What type of fee does a mutual fund sponsor often reduce the longer an investor holds a back-end load fund?

Using historical market data, which investment strategy's purchasing power is least susceptible to inflation risk?

Grant is a Dealing Representative with WealthPlus Securities Inc. Grant becomes a volunteer member of his local arena's Hockey Association and is appointed as the Association's new Treasurer. Which of the

following statements about Grant's appointment as Treasurer is CORRECT?

Which statement regarding the underwriting process and over-the-counter (OTC) markets is CORRECT?

Samantha will be retiring from her full-time job when she turns 60 and would like to use her non-registered investment plan as income until she is eligible to receive her full pension benefit at age 65. What systematic withdrawal plan should she choose?

Evan owns retractable preferred shares of Ingram Corp. Which statement CORRECTLY describes a key feature of Evan's shares?

Which investor's needs would be BEST met with an income trust?

A mutual fund representative meets with a young family whose net worth/level of wealth is categorized as low, but they have the potential to become wealthy. In general, the family seems susceptible to believing that market events are predictable. Also, the family has a stronger impulse to avoid losses than earn gains. How might the mutual fund representative effectively address each of the two biases, respectively?

What decision accounts for most of the success or failure of a portfolio?

What term refers to the minimum rate at which the Bank of Canada lends money on a short-term basis to chartered banks?

Which type of fund is least likely to produce capital gains income?

Details of a client's investment portfolio appear in the following table:

Type of Funds

Amounts Invested ($)

Canadian equity growth fund

15,000

TSX equity index fund

25,000

Canadian resources fund

75,000

Canadian equity value fund

95,000

What is the primary risk of this investment portfolio?

What focus within the Standard of Conduct addresses unsolicited client orders?

Which among the following BEST describes a company’s income statement?

Which of the following best describes implied needs of your clients?

Which of the following Dealing Representatives has CORRECTLY fulfilled their suitability obligation?

Which company usually fills the role of the custodian for a mutual fund?

What term describes the range of possible future outcomes on the price of a security?

A parent wants to put aside savings for his 20-year-old disabled daughter to use at age 65. He prefers funds that require minimal management, while maximizing potential returns during earlier years. Which type of fund is most appropriate, given this parent's objectives?

What type of risk is the fundamental risk factor for fixed-income securities?

In a mutual fund sales representative's interaction with clients, what term best describes a set of moral principles that incorporate both the letter of the law and the spirit of the law?

Your client contacts you requesting that you purchase a mutual fund based on a “hot tip” from a friend who has been a successful investor. What bias is your client most likely being affected by?

Which of the following statements best describes dollar-cost averaging?

Your client, a high-income earner in a high marginal tax bracket, is seeking to minimize the amount of tax he pays on investment income while continuing to invest in mutual funds. Which mutual fund would best meet his investment objective?

Which of the following is a characteristic of a bond fund?

Which of the following statements describes a feature of the Home Buyers’ Plan (HBP)?

Your clients, Jessica and Ken, want to buy a house next year. You recommend a money market fund. How do you think a money market fund will help Jessica and Ken reach their goal?

Which drawback of the comparison universe method makes average fund managers look more like underperformers as the comparison period lengthens?

A client has $100,000 in savings, $5,000 in bank accounts, and $10,000 in loans. Calculate his net worth.

A portfolio manager first analyzes a variety of asset mixes to determine an optimal portfolio and then adjusts the mix by monitoring and rebalancing. What is the name for the process the portfolio manager is following?

Solomon is a Dealing Representative who is excited about a new equity fund his dealer recently approved. He thinks investors will be attracted to the fund’s historical performance. He has a prospective new client, Madira, who is 25 years old. Madira has invested in mutual funds before, but not with Solomon’s dealer. She has made an appointment to open a new RRSP with Solomon’s firm.

What does Solomon need to do to make this a suitable recommendation?

Francis wants to redeem his US Asset Allocation Fund as he needs the money for a down payment for a home purchase. The current proceeds from the redemption are USD $27,859, and the current CAD/USD exchange rate is 0.7353.

How much will Francis receive in Canadian dollars when he redeems the Funds? Please round your answer to the nearest dollar.

Which of the following statements are CORRECT about labour sponsored investment funds (LSIFs)?

The owners of Underground Airways Ltd. want to take their privately owned corporation public through an initial public offering (IPO). They are speaking to a specialist from an investment dealer to determine

whether it would be advisable to become listed on a stock exchange or the over-the-counter (OTC) market.

In comparing the two options, which of the following considerations is TRUE?

What is the characteristic of a Stage 2 – Family Commitment investor that most affects the ability to save for the long term?

Natasha currently owns 2 mutual funds: a bond fund and a Canadian equity fund. She would like to use one of them as her registered retirement savings plan (RRSP) contribution for the year. From a tax efficiency perspective, which mutual fund should she contribute?

Sean purchases 500 units of Penn Canadian Equity Fund when the net asset value per unit (NAVPU) is $16.70. On December 15, the mutual fund’s NAVPU is $21. On December 16, the mutual fund declares a distribution of $1.25 per unit. Sean’s distribution is immediately reinvested and he purchases additional units of the mutual fund.

Which of the following statements about the effect of the distribution is correct?

Carol contributed $500 to her TFSA. $350 was invested in ABC Bank Canadian equity fund and $150 in the ZYX Global growth fund. The expected return for the funds is 8% and 9.8%, respectively. What is the expected return on her TFSA?

One of your clients, Sheldon, is 65 years old. He has $30,000 to invest. He has a low risk profile, and an investment objective of receiving regular income. He has a time horizon of 5 years.

Based on Sheldon's risk profile and investment objective, which of the following investment recommendations is MOST appropriate for Sheldon?

When can an individual legally start selling mutual funds?