ClaimCenter Business Analyst - Mammoth Proctored Exam Questions and Answers

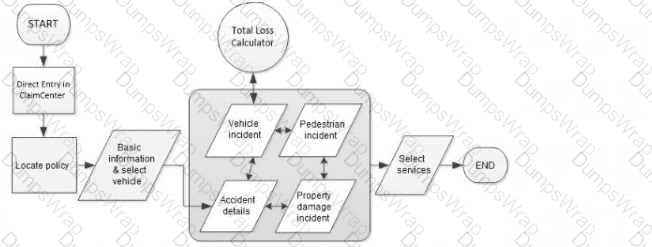

Whenever the Total Loss Calculator determines that a vehicle is a total loss, Succeed Insurance wants to create a custom history event with the exposure name and total loss score.

Which step in the claim setup process flow must be completed before the history event can be created?

Succeed Insurance has a requirement to add a new high-risk indicator to the Claim Status screen for property claims that have a lien on the property. A new icon will be added to the configuration to provide a visual indicator making it easier for Adjusters and other ClaimCenter users to determine that a claim has a lien.

Which two common areas of the user interface (UI) can display the new lien icon? (Choose two.)

An Adjuster at Succeed Insurance is handling a personal auto claim for an insured who hit a tree after swerving to avoid a child who ran into the road.

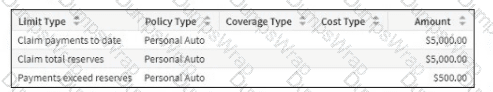

The Adjuster has this Authority Limit Profile:

The Adjuster creates a collision exposure and sets the initial reserves so that payments can be made to the insured for repairs to the damaged vehicle. No payments have been created yet.

The current financials for the claim are as follows:

Which two financial transactions will not require approval given that each option is the only transaction change rather than a cumulative change? (Choose two.)

An auto accident in Chicago, Illinois has been reported to Succeed Insurance. The customer service representative uses the ClaimCenter standard Claim Wizard to set up the new claim. The policy is verified in effect and based on the reported exposures the total loss points calculated is 38. There is also a note to have an expert inspection via approved vendor.

What is the most likely claim setup with regards to this reported auto accident?

Which two components are necessary to create the check(s) using the wizard? (Choose two.)

Which set of three objects is required to create a liability exposure?

To help manage new user setup, Succeed Insurance would like all manager-level employees to be able to add new users to ClaimCenter. Some managers are already assigned the Community Admin role, which has a set of permissions for the administration of the ClaimCenter community model that includes the permission to create new users.

Where are two places the Business Analyst (BA) can go to view the permissions assigned to manager-level users? (Choose two.)

Which scenario shows a Business Analyst (BA) demonstrating an important way to use Guidewire's Business Process Flows during a product implementation?

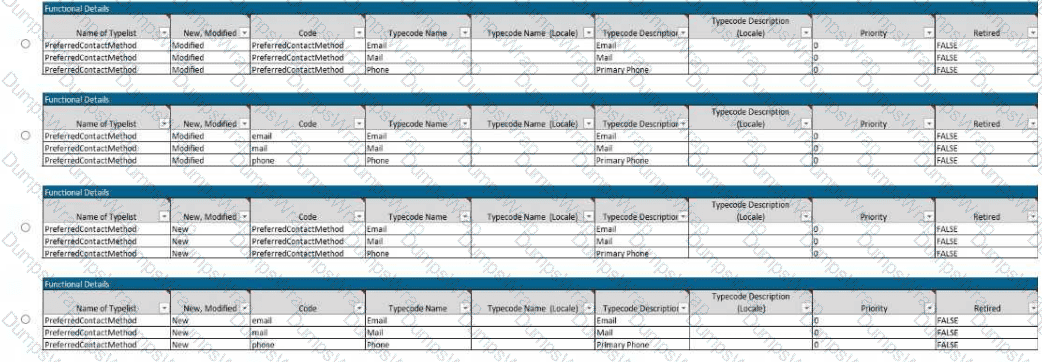

During claim intake and adjudication, Adjusters capture contact information for the insured and all claimants. To improve customer service and reduce the time required to reach these contacts to gather additional claim information, Succeed Insurance will capture the preferred contact method for all person contacts. The new field will be added to the contact details screen of the user interface (UI) as a drop-down list displaying all valid contact methods including email, mail, and phone.

Which version correctly lists the preferred contact methods in the Typelists tab of the Parties Involved User Story Card?

A performing arts organization operates nationwide and is responsible for setting up stages for musical acts and concerts. The organization requires specific insurance coverage for its gear and equipment, including audio systems, lighting, cameras, and control boards. Succeed Insurance wants to optimize claim intake, processing, and reporting for this organization.

Which modifications should be made to ClaimCenter’s base product line of business (LOB)?

Succeed Insurance needs the ability to associate a primary hospital with an injury incident if the injured party received treatment. When treatment is needed, the primary hospital name should display on the injury incident screen along with other details about the injury and treatment received.

The primary hospital should be added to the injury incident in one of the following ways:

. Select the name from a list of medical care organizations already associated with the claim.

. Enter the contact details directly in the incident.

. Search the Address Book from the incident to locate a hospital.

Which two requirements must be documented to associate the primary hospital with the claim? (Choose two.)

A catastrophe has been created in ClaimCenter for Tropic Storm Dorian. Succeed Insurance requires that all claims resulting from the storm be attributed to that catastrophe when they are entered in ClaimCenter. The completion target is within three (3) days of claim creation and should be escalated if it is not completed within five (5) days.

Which required element for a business activity rule is missing?

When creating a new Personal Auto claim, Succeed Insurance would like to identify when Rideshare is the primary use for a vehicle. A Business Analyst (BA) thinks that Primary Use already exists as a typekey on the Vehicle Details screen.

What are two ways the BA can confirm whether this field is configured in ClaimCenter and, if it is, which values are available in the typelist? (Choose two.)

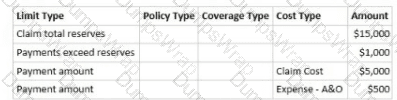

An Adjuster at Succeed Insurance is handling a homeowners claim with a dwelling exposure for damage to the insured's home. The Adjuster's Authority Limit Profile has the following limits:

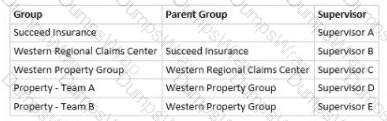

The table below is a view of the property claims organization within Succeed Insurance. The Adjuster is a member of the group Property - Team A.

The Adjuster creates a payment in the amount of $6,500 for repairs to the insured's home. How will it be processed assuming that the claim has sufficient reserves for the payment?

An Adjuster at Succeed Insurance creates a check with a partial payment of $1,200 for medical expenses payable to a claimant who was injured in a collision. The check has completed the following processing steps:

. The payment exceeded the Adjuster's authority limits, changing the status to Pending Approval.

. The Adjuster's supervisor reviewed and approved the payment, changing the status to Awaiting Submission.

. A batch process sent the check to the external check processing system, changing the status to Requested when ClaimCenter received an update from the external system.

The Adjuster received new information indicating that the check amount should be reduced to $950.

Which action should the Adjuster take?