Certified Pega Decisioning Consultant 25 Questions and Answers

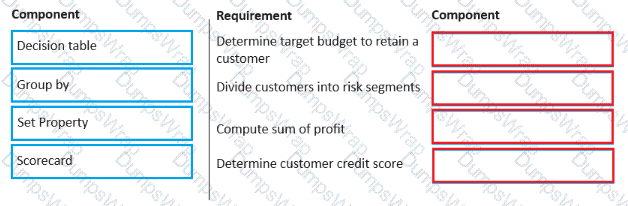

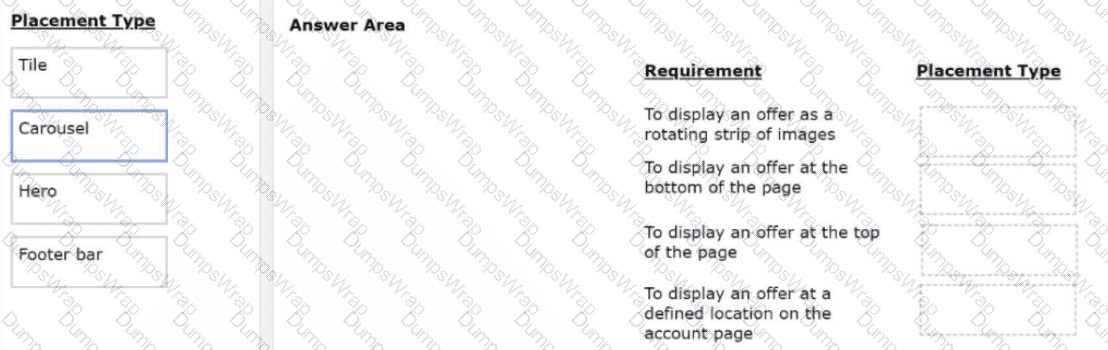

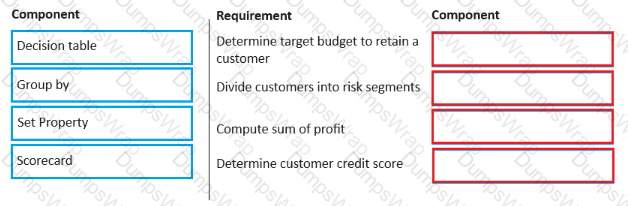

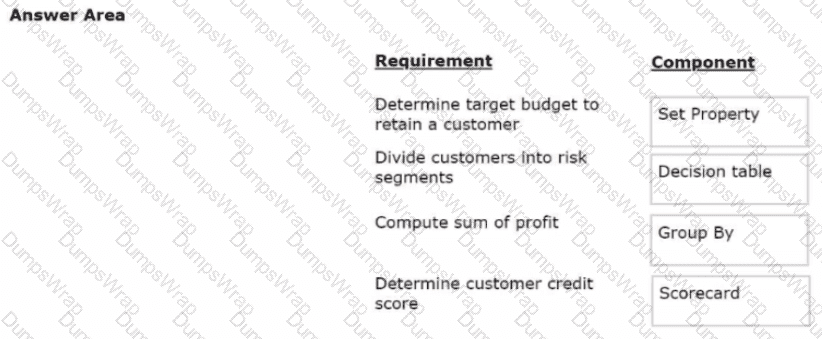

You are a deaccessioning architect on a next-best-action project and are responsible for designing and implementing decision strategies. Select each component on the left and drag it to the correct requirement on the right.

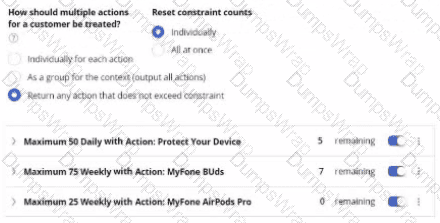

In the following figure, a volume constraint uses the Return any action that does not exceed constraint mode with the three following action type constraints that have remaining limits:

1.Maximum 50 Daily with Action: Protect Your Device, 5 remaining

2.Maximum 75 Daily with Action: MyFone Buds, 7 remaining

3.Maximum 25 Daily with Action: MyFone AirPods Pro, 0 remaining

A customer, CUST-01, qualifies for all the three actions. Given this scenario, how many actions does the system select for CUST-01 in the outbound run?

U+ Bank's marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want to show offers on a customer's account page if the customer has already received three home loan offers in the last two weeks.

What do you need to define to implement the business requirement?

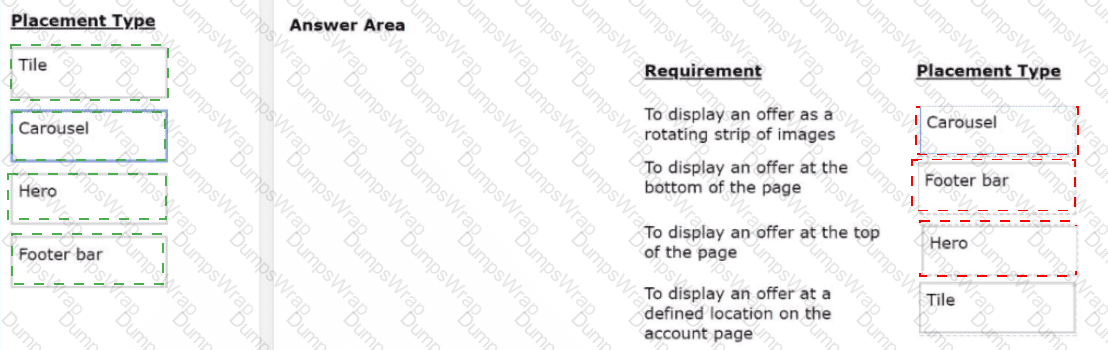

U+ Bank has decided to use the Pega Customer Decision Hub, M to recommend more relevant banner ads to its customers when they visit the personal portal. Select each placement type on the left and drag it to the correct requirement on the right.

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer. What is the next step that Pega Customer Decision Hub takes?

U+ Bank implemented a customer journey for its customers. The journey consists of five stages. The bank observes that as customers progress through the journey, one customer entered the third stage of the journey, and then received an offer that is not included in any journey.

Which statement explains the cause of this behavior?

Which of the following reasons explains why a customer might receive an action that they already accepted?

What is the name of the property that the system computes automatically when you use an Adaptive Model decision component?

U+- Bank uses Pega Customer Decision Hub'" for their one-to-one customer engagement. The bank now wants to change its offer prioritization to consider both business objectives and customer needs.

Which two factors do you configure in the Next-Best-Action Designer to implement this change? (Choose Two)

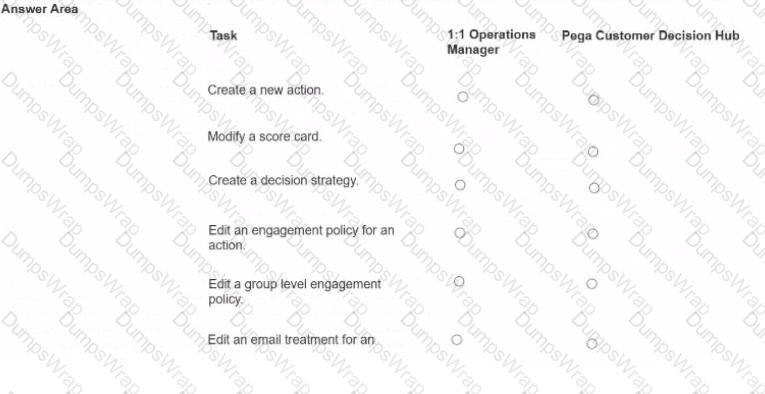

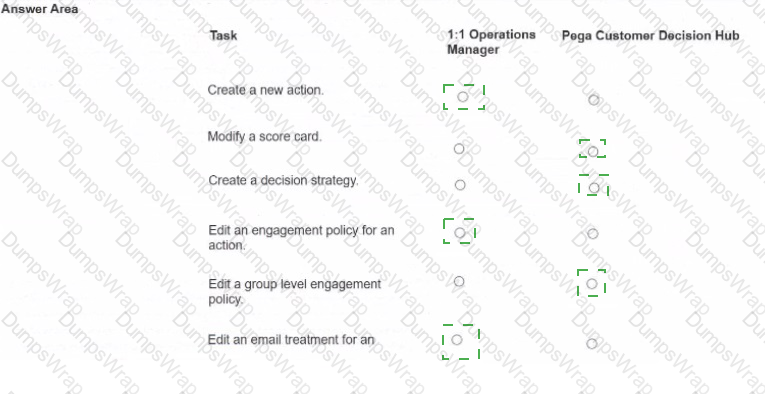

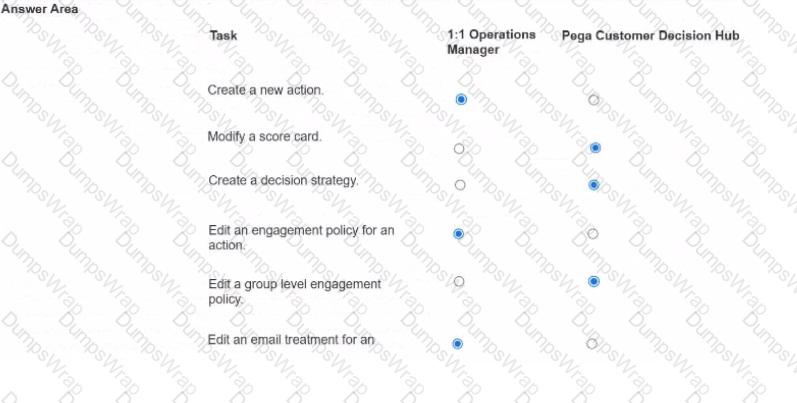

A financial institution's NBA team discovers that they need to modify their risk assessment strategy and edit a scorecard used for loan approvals. The team lead reviews the available options in 1:1 Operations Manager to determine the most appropriate approach to implementing these changes.

Which approach should the team lead use to implement these strategy and scorecard modifications?

A customer qualifies for Standard card (priority 60), Rewards card {priority 40), and Premium card {priority 30). Standard card volume is exhausted. Rewards card has remaining volume, and Premium card has remaining volume. The system uses "Return any action that does not exceed constraint" mode.

Which actions does the customer receive in this scenario?

MyCo, a telecom company, uses Pega Customer Decision Hub™ to present offers to qualified customers. The business recently decided to send offer messages through the email channel. The Design department has designed an email treatment which includes dynamic placeholders.

As a deaccessioning architect, what do you use in order to test the visualization and the rendering of the email content, including replacing of the placeholders with customer information?

U+ Bank, a retail bank, uses the business operations environment to perform its business changes. The bank carries out these changes in the Pega Customer Decision Hub portal by using revision management features or the 1:1 Operations Manager portal.

For each task, select the correct portal in which you perform the build tasks based on best practices.

A financial services organization introduces a new policy that limits each customer to two promotional emails per month. To meet compliance requirements, the implementation team must configure this limit in the Next-Best-Action Designer.

Which configuration steps achieve the desired email frequency limit?

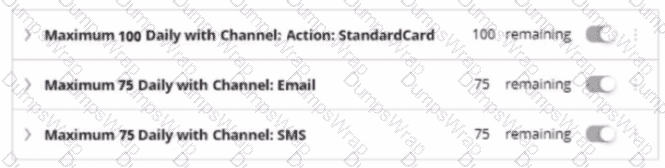

U+ Bank uses the always-on outbound approach to send outbound messages on different channels such as email. SMS, and push notifications. There are a variety of action flow patterns in use to meet various business and channel integrations requirements.

Due to technical reasons, the bank wants to temporarily suspend sending outbound messages and Instead write the selected customers and action details to a database table for later offline processing.

What is the most efficient way to meet this requirement?

U+Bank presents various credit card offers to Its customers on Its website. The bank uses AI to prioritize the offers according to customer behavior. After the introduction of the Gold credit card offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

U+- Bank uses Next-Best-Action Designer to configure engagement policies for different customer segments. A business user wants to create reusable policy conditions that can apply across multiple actions and campaigns. The user must understand when the save-to-library feature is available.

When is the save-to-library option unavailable for engagement policy conditions?

U+ Bank, a retail bank, has purchased Pega Customer Decision Hub. The bank currently uses an external tool to design email content and a third-party email service provider to send emails to its customers.

As a decisioning architect, how do you recommend the bank implements this requirement?

Pega Customer Decision Hub enables organizations to make Next-Best decisions. To which type of a decision is Next-Best-Action applied?

U+ Bank implemented a customer journey for its customers. The journey consists of three stages. The first stage raises awareness about available products, the second stage presents available offers, and in the last stage, customers can talk to an advisor to get a personalized quote. The bank wants to actively increase offers promotion over time.

What action does the bank need to take to achieve this business requirement?

U+ Bank observes that some customers receive the same credit card offer multiple times within a short period, which results in dissatisfaction. The bank wants to suppress a specific credit card offer if it has been shown three times within seven days.

What should you configure in the Contact Policy to prevent a specific credit card offer from being shown to a customer more than three times in seven days?

An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel. If the following volume constraint is applied, how many actions are delivered by the outbound run?

In a decision strategy, to use a customer property in an expression, you

U+ Bank's marketing department wants to use the always-on outbound approach to send promotional emails about credit card offers to qualified customers. As a part of this promotion, the bank wants to identify the starting population by defining a few high-level criteria in a segment.

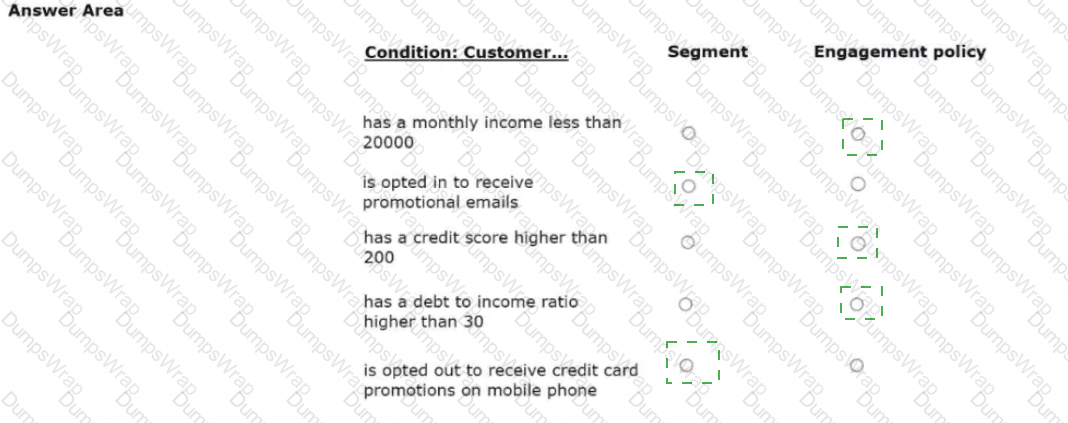

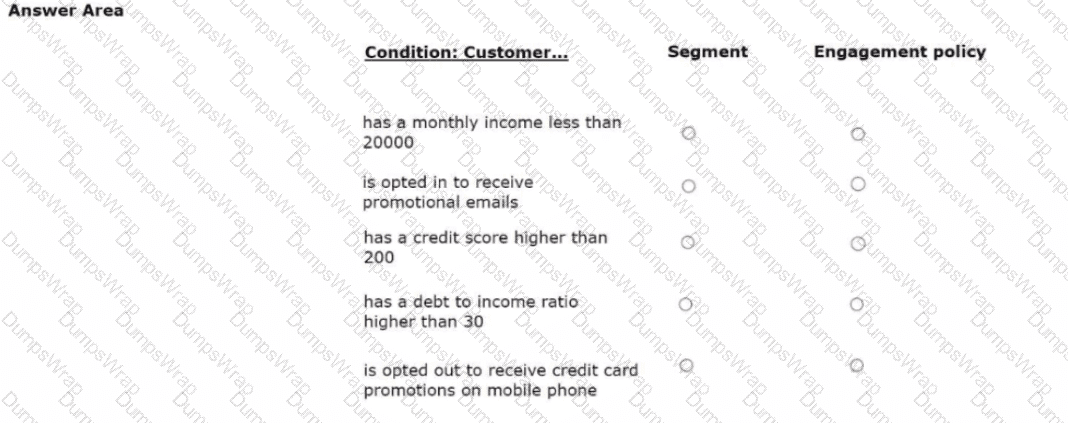

For each condition below, select which two conditions should be defined in Segment and which three conditions should be defined in Engagement policy as best practice.

MyCo, a telecom company, wants to Include offer-related images in the emails that they send to their qualified customers. As a decisioning architect, what best practice do you follow to include images in emails?

The development team at U+Bank wants to create multiple test personas for their new engagement strategy quickly. A team member suggests using Pega GenAI features instead of creating a manual persona to improve efficiency and speed up the testing process.

Which advantage does Pega GenAI provide when creating personas compared to manual creation?

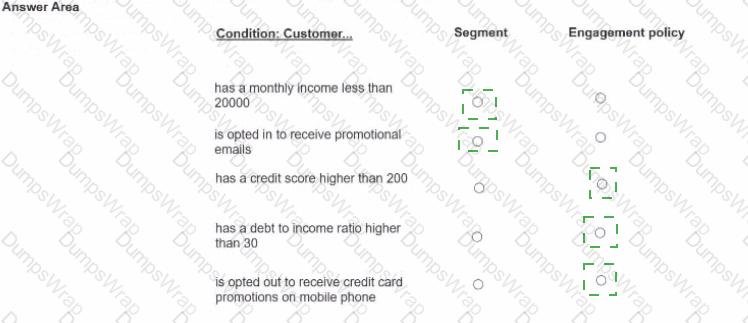

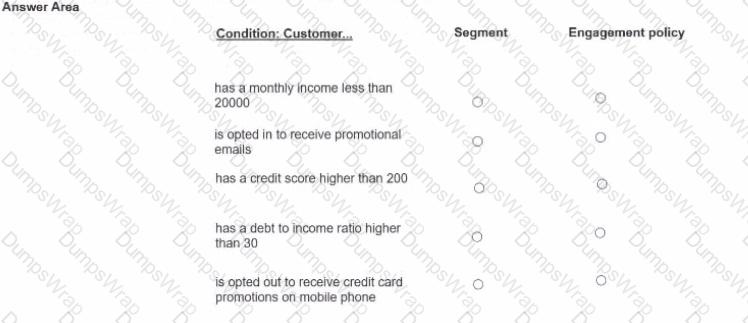

U+ Bank's marketing department wants to use the always-on outbound approach to send promotional emails about credit card offers to qualified customers. As a part of this promotion, the bank wantsto identify the starting population by defining a few high-level criteria ina segment.

For each condition below, select which two conditions should be defined in Segment and which three conditions should be defined in Engagement policy as best practice

U+ Bank, a retail bank, is currently presenting a cashback offer on its website.

Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer:

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45.

As a business user, what are the two tasks that you define to update the cashback offer? (Choose Two)

U+ Bank, a retail bank, is facing an unforeseen technical issue with its customer care system. As a result, the bank wants to share the new temporary contact details with all customers over an SMS. All customers must receive this communication regardless of the engagement policy conditions and constraints.

Which type of communication do you configure to implement this requirement?

U+ Bank is designing a customer journey to increase credit card usage among new customers. The journey includes several stages with specific actions triggered by customer behavior. The bank wants to ensure that customers receive the most relevant actions based on their engagement.

Which stage arbitration option should the NBA Specialist select to ensure that customers always progress in the journey without reverting to previous stages?

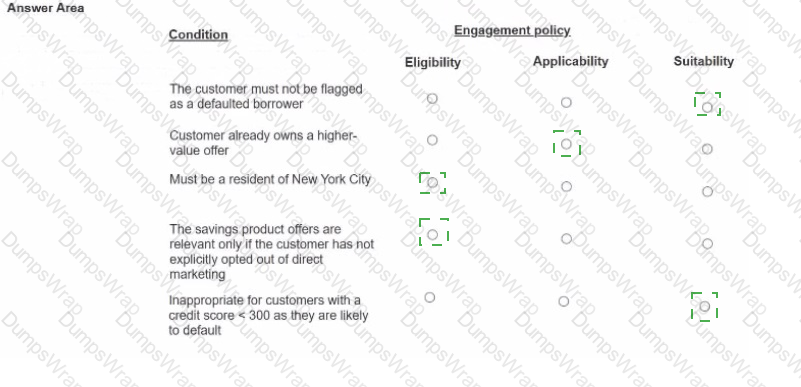

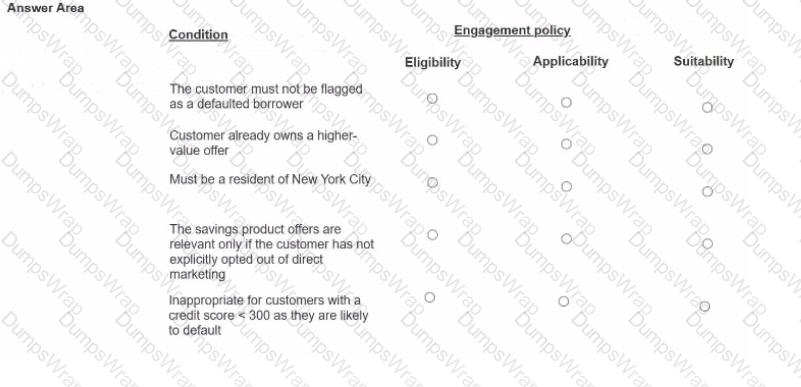

U+ Bank, a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in to the web self-service portal The Dank added engagement policy conditions to show the offers based on the bank's requirements.

In the Answer Area, select the correct engagement policy for each condition.

A close-up of a list of words AI-generated content may be incorrect.

A close-up of a list of words AI-generated content may be incorrect.

C:\Users\Waqas Shahid\Desktop\Mudassir\Untitled.jpg

C:\Users\Waqas Shahid\Desktop\Mudassir\Untitled.jpg