Certified Pega Decisioning Consultant (PCDC) 87V1 Questions and Answers

In a Decisioning Strategy, which decision component is required to enable access to the Customer properties like age, income, etc.?

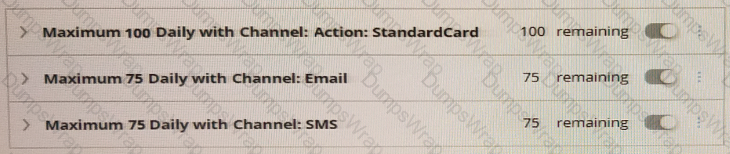

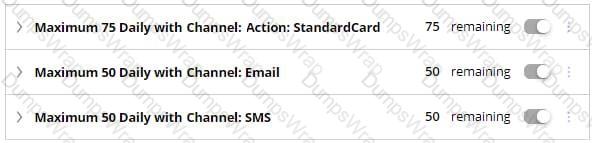

An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel.

If the following volume constraint is applied, how many actions are delivered by the outbound run?

As a decisioning consultant, you advise the board on the business issues for which they must use the Next-Best-Action strategy.

Which three business issues do you recommend? (Choose Three)

Traditionally, segments were used to identify the target audience for a campaign. In the always-on approach, segments translate into _______.

A marketer created a segment as the starting population for the outbound schedule. In Options and Schedule, she enabled the Refreshable Segment option. What does this option do?

U+ Bank uses a scorecard rule in a decision strategy to compute the mortgage limit for a customer. U+ Bank updated their scorecard to include a new property in the calculation: customer income.

What changes do you need to make in the decision strategy for the updated scorecard to take effect?

U+ Bank wants to leverage Pega Customer Decision Hub's Next Best Action capability to promote new offers to each customer who visits the website based on eligibility. For this requirement, the bank needs to define several complex eligibility criteria. As a decision consultant, how would you configure this requirement?

Reference module: Creating eligibility rules using customer risk segments.

U+ Bank uses a decision table to return a label for a customer. Examine this decision table and select which label is returned for a customer with a credit score of 115 and an average balance of 15000.

As a Decisioning Consultant, you are tasked with configuring the ethical bias policy. Which context do you need to select to add bias fields?

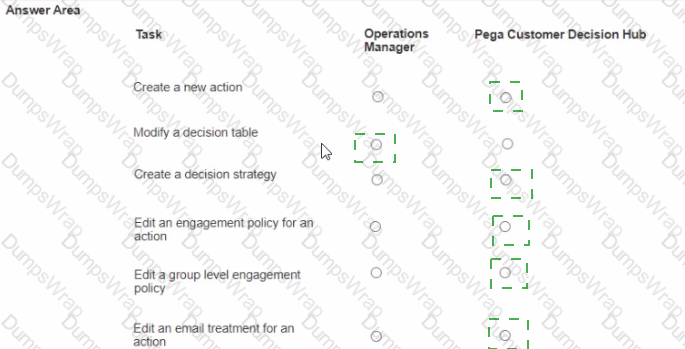

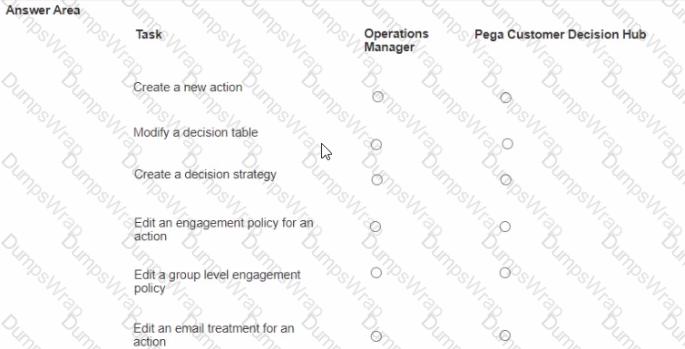

U+ Bank a retail bank, uses the Business Operations Environment to perform its business changes The bank carries out these changes m the Pega Customer Decision Hub portal by using revision management features or the V1 Operations Manager portal

For each task, select the correct portal in which the tasks are performed based on best practices

Reference module: Adding more tracking time periods for contact policies

A bank is currently displaying a group of mortgage offers to its customers on their website. The bank wants to suppress the mortgage group for 15 days if a customer ignores three offers from the mortgage group. How do you define the suppression rule for this requirement?

A bank would like to write action details to a file so that it can be shared with a third-party email distributor. The bank has instructed their consultant to ensure the action details are finalized at the end of each run. In this context, what does finalization mean?

MyCo, a mobile company, uses Pega Customer Decision Hub™ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning consultant, what do you configure to select the best offer from both groups based on customer behavior?

An outbound run identifies 100 Standard Card offers, 50 on email and 50 on the SMS channel. If the above volume constraint is applied, how many actions will be delivered by the outbound run?

Reference module: Creating and understanding decision strategies. In a decision strategy, to use a customer property in an expression, you _____.

MyCo, a telecom company, wants to present their customers on Facebook with customer-centric mobile internet offers. What action must MyCo take to meet this business requirement?

Reference module: Defining an action for outbound

Which statement is true about email treatments?

Reference module: Testing engagement policy conditions using audience simulation

As a Decisioning Consultant, you are tasked with running an audience simulation to test the engagement policy conditions. Which of following statements is true when the simulation scope is Audience simulation with engagement policy and arbitration?

U+ Bank has recently introduced a few mortgage offers that are presented to qualified customers on its website- The business now wants to prevent offer overexposure, as overexposure negatively impacts the customer experience.

Select the correct suppression rule for the requirement: If a customer has clicked on any of the mortgage offers a total of three times in the last 7 days, do not show any mortgage offers to that customer for the next 10 days.

The U+ Bank marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want customers to receive more than four promotional emails per quarter, regardless of past responses to that action by the customer.

Which option allows you to implement the business requirement?

Which two of these statements are true about creating segments? (Choose Two)

A bank wants to sell more mortgages in the fourth quarter and is willing to offer mortgages even in situations where a credit card may have created more value. Which arbitration factor do you configure to implement this requirement?

MyCo, a mobile company, uses Pega Customer Decision Hub™ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning consultant, what must you do to present offers from the two groups?

U+ Bank promotes credit card offers on its website and uses Pega Customer Decision Hub to personalize the offer for every customer. Now, the bank wants to lower the number of customers that leave the bank by showing a proactive retention offer to high churn risk customers instead. As an NBA analyst, you are tasked with creating a new applicability setting to comply with the new business rule. Which business issue or issues do you modify?

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer.

What is the next step that Pega Customer Decision Hub takes?

U+ Bank wants to introduce a new group of offers called Credit cards for all customers. As a decisioning consultant, which two valid actions do you create? (Choose Two)

As a Decisioning consultant, you are tasked with running an audience simulation to test the engagement policy conditions. Which statement is true when the simulation scope is: Audience simulation with engagement policy and arbitration?

U+ Bank, a retail bank, wants to begin promoting credit card offers via email to qualified customers. The business would like to ensure that the outbound run always uses the latest customer information.

What do you configure to implement this requirement?

U+ Bank's marketing department wants to promote various auto loan offers to qualified customers on its website by using the Pega Customer Decision Hub™. The bank wants to show the offers on the customer's account page when customers log in to their account. The bank has defined several conditions customers must satisfy to see these auto loan offers.

As a decisioning consultant, which two of the following configurations do you implement to achieve the business requirement? (Choose Two)

Myco, a telco, wants to present their customers with new credit card offers – the Diamond card, the Platinum card, and the Gold card – on their web portal. As a decisioning consultant, you want to determine which will be the best performing action by running a distribution test. In this scenario, which report will test this requirement?

In the primary schedule recurrence configuration, what does the Refresh the audience option mean?

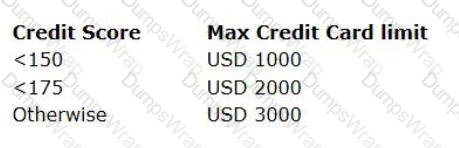

U+ Bank uses a Next-Best-Action decision strategy to automatically approve credit card limit changes requested by customers. A scorecard model determines the customer credit score. The automatic approval of credit card limits are processed based on the following criteria set by the bank:

The bank wants to change the threshold value for the USD 2000 credit limit from “<175” to “<200”.

As a Strategy Designer, how do you implement this change?

Reference module: Creating and understanding decision strategies.

What does a dotted line from a Group By component to a Filter component mean?

An outbound run identifies 100 Standard Card offers, 50 on email and 50 on the SMS channel. If the above volume constraint is applied, how many actions will be delivered by the outbound run?

U+ Bank's marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want to show offers on a customer's account page if the customer has already received three home loan offers in the last two weeks.

What do you need to define to implement the business requirement?

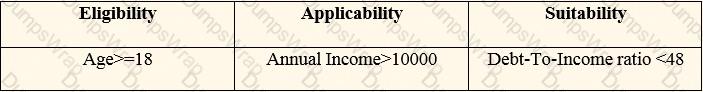

U+ Bank, a retail bank, is currently presenting a cashback offer on its website. Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer.

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45 As business user, what are the two tasks that you define to update the cashback offer? (Chose Two)

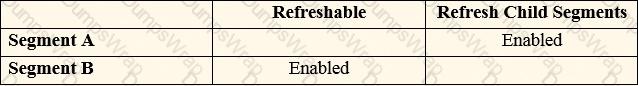

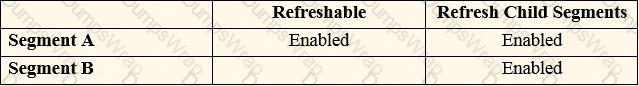

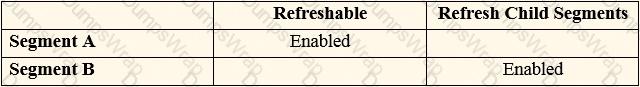

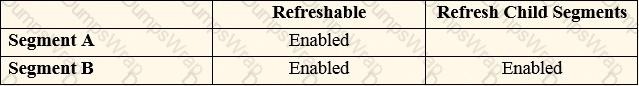

There are two segments: segments A and Segments B. The segments A references the segment B.

Which configurations is necessary to make sure that segment B is automatically refreshes when segment A is refreshed?

Reference module: Leveraging predictive model.

U+, a retail bank, wants to show a retention offer to customers who are likely to leave the bank in the near future based on historical customer interaction data. Which type of model do you use to implement this requirement?

Next-Best-Action ensures that communication between the business and the customer is__________ and __________ (Choose Two)

U+ Bank, a retail bank, presents various credit card offers to its customers on its website. The bank uses artificial intelligence (AI) to prioritize the offers based on customer behavior. Since introducing the Gold credit card offer, the offer click through rate propensity has increased to 0.83.

What does the increase in the propensity value most likely indicate?

U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. You have already created an action flow template with the desired flow pattern and reused it for all the credit card actions.

What must you do to ensure that this action is not selected for any customers?

Using Pega Customer Decision Hub, a mobile company transitions from a one-to-many to a one-to-one marketing approach. The company is introducing a new data plan.

Which two channels can the company use to present the new data plan to a customer? (Choose Two)

To access a property from an unconnected component, you use the____________.

U+ Bank has recently started using Pega Customer Decision Hub™ to display the first credit card offer, the Standard card, to every customer who logs in to their website.

Which three tasks do you need to perform to implement this requirement? (Choose Three)

U+ Bank’s marketing department currently promotes various credit card offers by sending emails to qualified customers. Now the bank wants to limit the number of emails sent to their customers irrespective of past outcomes with a particular offer and customer. Which of the following options allows you to implement this business requirement?

MyCo, a telecommunications company, wants to implement one-to-one customer engagement using Pega Customer Decision Hub™. Which of the following real-time channels can the company use to present Next-Best-Actions? (Choose Three)

Reference module: Creating and understanding decision strategies

In a decision strategy, to use a customer property in an expression, you _____.

U+, a retail bank, does not want to offer a Gold card to customers who already have a Platinum card. Which engagement policy condition best suits this requirement?

Reference module: Creating and understanding decision strategies

In a Prioritize component, the top action can be determined based on the value of ________ .

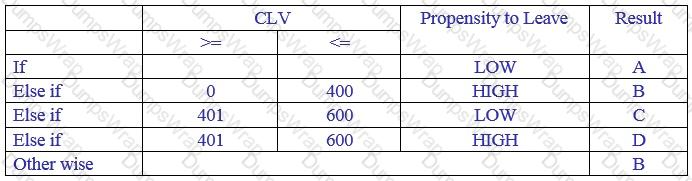

U+ bank uses a decision table to return a label for a customer. Examine the above decision table and select which label is returned for a customer with a CLV score of 550 and a LOW propensity to leave

In an organization, customer actions are applicable to various business issues. What is the best way to organize them?

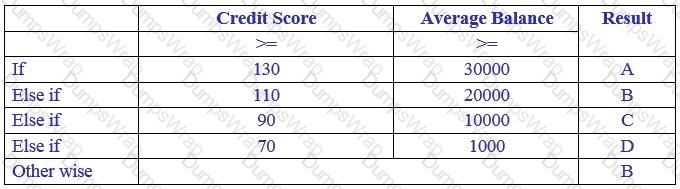

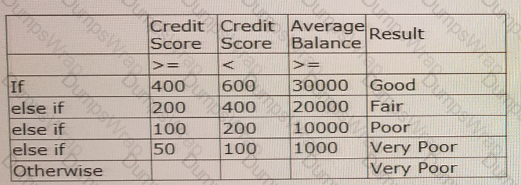

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

Reference module: Testing engagement policy conditions using audience simulation

U+ Bank, a retail bank, recently implemented a project in which mortgage offers are presented to qualified customers when the customers log in to the web self-service portal. As one of the offers is not performing well, the business wants to understand how many customers qualify for the offer. As a Decisioning Consultant, which simulation do you run to check how many customers qualify for an action?

To reference a customer property in a strategy, you need to prefix the property name with the keyword______________.

U+ Bank, a retail bank, does not want to annoy customers by offering them a mortgage refinance option if they have less than 5% to pay off on their loan, although it would be profitable for the bank. Which engagement policy condition best suits this requirement?