Internal Audit Engagement Questions and Answers

What is the primary purpose of issuing a preliminary communication to management of the area under review?

When determining the level of staff and resources to be dedicated to an assurance engagement, which of the following would be the most relevant to the chief audit executive?

Which of the following is an inherent risk of issuing an opinion on the overall effectiveness of internal control?

During an assurance engagement, an internal auditor discovered that a sales manager approved numerous sales contracts for values exceeding his authorization limit. The auditor reported the finding to the audit supervisor, noting that the sales manager had additional new contracts under negotiation. According to IIA guidance, which of the following would be the most appropriate next step?

An internal audit function described scenarios of fraud indicators and fraud-related key words. The objective is for this data to serve as an input into algorithms that will forecast potentially fraudulent behavior and prevent the execution of flagged transactions. Which of the following analytic methods is the internal audit function most likely developing?

An internal auditor is reviewing the accuracy of commission payments by recalculating 100% of the commissions and comparing them to the amount paid. According to IIA guidance, which of the following actions is most appropriate for identified variances?

A toy manufacturer receives certain components from an overseas supplier and uses them to assemble final products Recently quality reviews have identified numerous issues regarding the components' compliance with mandatory quality standards. Which type of engagement would be most appropriate to assess the root causes of the quality issues?

When using cost-volume-profit analysis, which of the following will increase operating income once the break-even point has been reached?

An audit client responded to recommendations from a recent consulting engagement. The client indicated that several recommended process improvements would not be implemented. Which of the following actions should the internal audit activity take in response?

According to MA guidance, which of the following factors should an internal auditor consider when assessing the likelihood of fraud risk1?

An internal auditor suspects that a program contains unauthorized code or errors. Which of the following would assist the internal auditor in this regard?

Which of the following should be included in a company's year-end inventory valuation?

Which of the following is one of the advantages of organizing the risk universe by processes?

The engagement supervisor would like lo change the audit program's scope poor to beginning fieldwork According to IIA guidance before any change is implemented what is the most important action that should be undertaken?

The internal auditor and her supervisor are in dispute about a risk that was not tested during an audit of the procurement function. Which of the following tools would best support the auditor's decision not to test the risk?

During the planning stage of an assurance engagement, an internal auditor has been assigned to prepare a risk matrix. Which of the following should the internal auditor consider when attempting to identify process-level risks?

A new internal auditor is overwhelmed by the number of tasks they need to complete at the engagement planning stage. Which of the following could support the auditor’s organization and delivery of planned work?

Which of the following statements is false regarding audit criteria?

According to IIA guidance, which of the following is the most appropriate action to be taken by the chief executive (CAE) if management refuses to accept audit recommendations and implement corrective actions, Even after escalation to senior management?

Which of the following is true regarding the communication of engagement results with stakeholders?

According to IIA guidance, which of the following objectives was most likely formulated for a non-assurance engagement?

Which of the following statement is consistent with IIA guidance the use of mentoring for internal auditors?

The internal audit activity has adopted the balanced scorecard approach to assess its performance According to MA guidance which of the following is a key performance indicator relevant to the audit client?

Which of the following statements is true regarding engagement planning?

An internal auditor developed a list of internal and external risk considerations across the organization's processes, developed a scale to assess each risk and allocated the relative importance of each risk. When of the following approaches did the auditor take?

'Internal policy prohibits employees from entering into contacts with financial obligations without proper approval.

A project manager signed a change to an important service agreement without obtaining the proper approval As a result the organization is receiving $5,000 per month less for its services.’’

Which of the following should be added to the observation?

During the review of an organization's retail fraud deterrence program, an employee mentions that an expensive fraud surveillance information system is rarely used. The internal auditor concludes that additional staff are required to properly utilize the system to its full potential. According to IIA guidance, which criteria for evidence is most lacking to reach this conclusion?

An internal auditor is assigned to validate calculations on the organization's building application As pad of the test the internal auditor is required to use an automated audit tool to simulate transactions for testing. Which of the following would most appropriately be used for this purpose?

The chief audit executive (CAE) should determine whether the internal audit activity has confirmed the status of all of management's corrective actions Doing so would help the CAE assess which of the following?

An internal auditor is asked to determine why the production line for a large manufacturing organization has been experiencing shutdowns due to unavailable parts The auditor learns that production data used for generating automatic purchases via electronic interchange is collected on personal computers connected by a local area network (LAN) Purchases are made from authorized vendors based on both the production plans for the next month and an authorized materials requirements plan (MRP) that identifies the parts needed per unit of production. The auditor suspects the shutdowns are occurring because purchasing requirements have not been updated for changes in production techniques. Which of the following audit procedures should be used to test the auditor's theory?

An internal auditor notes that employees continue to violate segregation-of-duty controls in several areas of the finance department, despite previous audit recommendations. Which of the following recommendations is the most appropriate to address this concern?

According to IIA guidance, which of the following describes the primary reason the chief audit executive (CAE) should actively network and build relationships with senior management and the board?

The internal audit team judgmentally selected 60 of the 600 employee timesheets that were processed during the previous month to determine whether supervisors were properly approving timesheets in accordance with the organization's policies. The internal audit team found three exceptions. Based on the audit test, which of the following is most appropriate for the internal audit team to conclude?

A chief audit executive (CAE) received a detailed internal report of senior management's internal control assessment. Which of the following subsequent actions by the CAE would provide the greatest assurance over management's assertions?

An organization's internal audit plan includes a recurring assurance review of the human resources (HR) department. Which of the following statements is true regarding preliminary communication between the auditor in charge (AIC) and the HR department?

1. The AIC should notify HR management when the draft audit plan is being developed, as a courtesy.

2. The AIC should notify HR management before the planning stage begins.

3. The AIC should schedule formal status meetings with HR management at the start of the engagement.

4. The AIC should finalize the scope of the engagement before communicating with HR management.

The board has asked the internal audit activity (IAA) to be involved in the organization's enterprise risk management process. Which of the following activities is appropriate for IAA to perform without safeguards?

Which of the following is an example of a properly supervised engagement?

Which of the following best describes the four components of a balanced scorecard?

According to IIA guidance, when of the Mowing statements is true regarding an engagement supervisor's use of review notes?

At the conclusion of a quality assurance review, the chief audit executive (CAE) was informed that several audits included incomplete workpapers, and some workpapers were not completed within the established timeframe. How should the CAE address the issue of incomplete workpapers?

According to IIA guidance, which of the following would be considered necessary for a one-person audit function?

Which of the following statements is true regarding different competitive strategies?

An internal audit activity maintains a quality assurance and improvement program that includes annual self-assessments The internal audit activity includes in each engagement report a clause that the engagement is conducted in conformance with the International Standards for the Professional Practice of Internal Auditing (Standards). Which of the following justifies inclusion of this clause in the reports?

Which of the following is an advantage of utilizing an external fraud specialist in a suspected fraud investigation?

Which of the following internal audit activity staffing models has the disadvantage that auditors are always new and in training?

According to IIA guidance, which of the following individuals should receive the final audit report on a compliance engagement for the organization's cash disbursements process?

Which of the following statements is true regarding internal auditors and other assurance providers?

An organization is expanding into a new line of business selling natural gas. The internal auditor is planning an engagement and wants to obtain a general understanding of the natural gas market the market share that the organization wants to win, and the competitive advantage that the organization may have. Which of the following would be the best source of such information?

Which of The following best justifies an internal auditor's decision to issue a preliminary audit report?

According to IIA guidance, which of the following activities is most likely to enhance stakeholders' perception of the value the internal audit activity (IAA) adds to the organization?

1. The IAA uses computer-assisted audit techniques and IT applications.

2. The IAA uses a consistent risk-based approach in both its planning and engagement execution.

3. The IAA demonstrates the ability to build strong and constructive relationships with audit clients.

4. The IAA frequently is involved in various project teams and task forces in an advisory capacity.

According to IIA guidance, which of the following corporate social responsibility (CSR) evaluation activities may be performed by the internal audit activity?

1.Consult on CSR program design and implementation

2.Serve as an advisor on CSR governance and risk management.

3.Review third parties for contractual compliance with CSR terms

4Identify and mitigate risks to help meet the CSR program objectives

While reviewing the workpapers and draft report from an audit engagement, the chief audit executive (CAE) found that an Important compensating control had not been considered adequately by the audit team when it reported a major control weakness Therefore, the CAE returned the documentation to the auditor in charge for correction Based on this Information, which of the following sections of the workpapers most likely would require changes?

1.Effect of the control weakness.

2.Cause of the control weakness

3.Conclusion on the control weakness.

4.Recommendation for the control weakness.

Which of the following statements is true regarding an organization’s inventory valuation?

During the planning phase of an assurance engagement, an internal auditor seeks to gam an understanding of now when the area under review is accomplishing its objectives When of the

Following information-gathering techniques is the auditor most likely to use?

An internal auditor completed a test of 30 randomly selected accounts. For five of the accounts selected, the auditor was unable to find supporting documentation in the normal place of storage. Which of the following next steps would be most appropriate for the internal auditor to take?

Which of the following attribute sampling methods would be most appropriate to use to measure the total misstatement posted to an accounts payable ledger?

An internal audit activity has to confirm the validity of the activities reported by a grantee that received a chantable contribution from the organization Which of the following methods would best help meet this objective?

During planning, the chief audit executive submits a risk-and-control questionnaire to management of the activity under review. Which of the following statements is true regarding the questionnaire?

According to IIA guidance, which of the following is true regarding audit supervision?

1. Supervision should be performed throughout the planning, examination, evaluation, communication, and follow-up stages of the audit engagement.

2. Supervision should extend to training, time reporting, and expense control, as well as administrative matters.

3. Supervision should include review of engagement workpapers, with documented evidence of the review.

A regional entertainment organization is in the process of developing a corporate social responsibility (CSR) policy. Management invites ideas from employees when developing the CSR policy Which of the following is the most appropriate idea to include?

Which of the following types of policies best helps promote objectivity in the internal audit activity’s work?

After concluding a preliminary assessment, the engagement supervisor prepared a draft work program According to HA guidance which of the following would be tested by this program?

Which of the following is most appropriate for internal auditors to do during the internal audit recommendations monitoring process?

An internal auditor is analyzing sates records and is concerned whether a transaction is recorded in the coned period. The accounting manager explains that the external auditor approved the records and produces an email from the external audit team leader. How should tie internal auditor respond?

To compete in the global market, an organization is restructuring and consolidating many of its divisions. Prior to the consolidation, senior management requested assistance from tie internal audit activity. Which of the following consulting services would be most appropriate in this situation?

Which of the following statements is true regarding internal control questionnaires?

For which of the following fraud engagement activities would it be most appropriate to involve a forensic auditor?

An internal auditor is asked to determine why the production line for a large manufacturing organization has been experiencing shutdowns due to unavailable pacts The auditor learns that production data used for generating automatic purchases via electronic interchange is collected on personal computers connected by a local area network (LAN) Purchases are made from authorized vendors based on both the production plans for the next month and an authorized materials requirements plan (MRP) that identifies the parts needed per unit of production The auditor suspects the shutdowns are occurring because purchasing requirements have not been updated for changes in production techniques. Which of the following audit procedures should be used to test the auditor's theory?

An internal auditor is conducting an assessment of the purchasing department. She has worked the full amount of hours budgeted for the engagement; however, the audit objectives are not yet complete. According to IIA guidance, which of the following are appropriate options available to the chief audit executive?

1. Allow the auditor to decide whether to extend the audit engagement.

2. Determine whether the work already completed is sufficient to conclude the engagement.

3. Provide the auditor feedback on areas of improvement for future engagements.

4. Provide the auditor with instructions and directions to complete the audit.

An internal auditor is preparing an internal control questionnaire for the procurement department as part of a preliminary survey. Which of the following would provide the best source of information for questions?

The internal audit function is performing an assurance engagement on the organization’s environmental, social, and governance (ESG) program. The engagement objective is to determine whether the ESG program’s activities are meeting the program’s established goals. The internal audit function has completed a risk and control assessment of the ESG program's activities. What is the appropriate next step?

For a new board chair who has not previously served on the organization’s board, which of the following steps should first be undertaken to ensure effective leadership to the board*?

The chief audit executive (CAE) of an organization has completed this year’s risk-based audit plan and realized that current staff resources are insufficient to meet the needs of the plan. What course of action should the CAE take?

Which of the following statements describes an engagement planning best practice?

Internal auditors map a process by documenting the steps in the process, which provides a framework for understanding Which of the following is a reason to use narrative memoranda?

Which of the following scenarios is an example of appropriate engagement supervision?

According to IIA guidance, which of the following would not be a consideration for the internal audit activity (IAA) when determining the need to follow-up on recommendations?

A draft internal audit report that cites deficient conditions generally should be reviewed with which of the following groups?

1. The client manager and her superior.

2. Anyone who may object to the report’s validity.

3. Anyone required to take action.

4. The same individuals who receive the final report.

The audit manager asked the internal auditor to perform additional testing because several irregularities were found in the financial information. Which of the following would be the most appropriate analytical review for the auditor to perform?

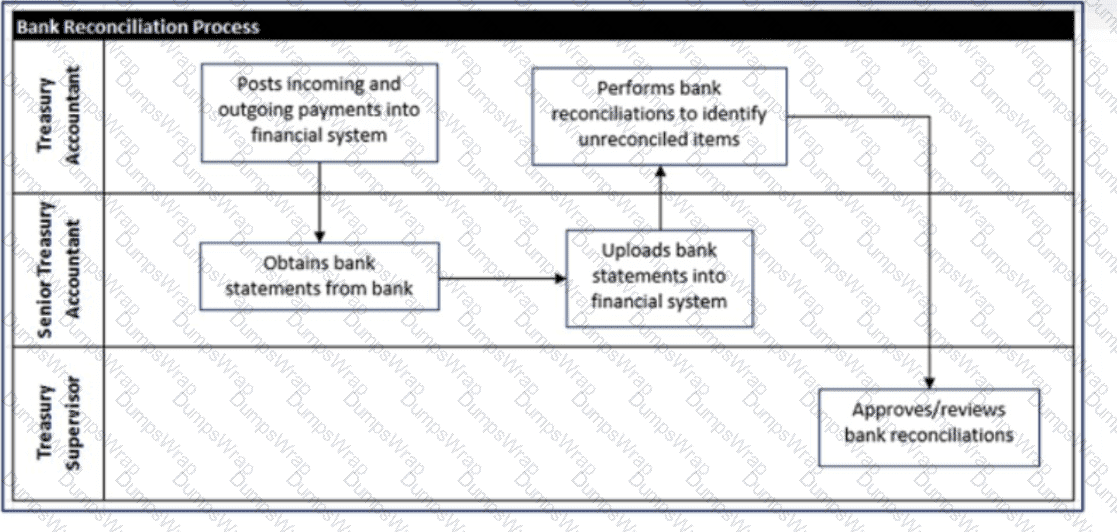

Below is a flowchart detailing an organization's bank reconciliation process. Which of the following conclusions can be drawn from the flowchart?

Which of the following statements generally true regarding audit engagement planning?

Which of the following should be included in a privacy audit engagement?

1. Assess the appropriateness of the information gathered.

2. Review the methods used to collect information.

3. Consider whether the information collected is in compliance with applicable laws.

4. Determine how the information is stored.

An internal audit intends to create a risk and control matrix to better understand the organization's complex manufacturing process. With which of the following approaches would the auditor most likely start?

An internal auditor determined that the organization's accounting system was designed to reject duplicate invoices if they were issued with identical invoice numbers. However, if an invoice number was changed by at least one digit, the system would accept the duplicate invoice as new. Which of the following would be the most appropriate criteria to refer to in the audit observation?

What is the best course of action for a chief audit executive if an internal auditor identifies in the early stage of an audit that some employees have inappropriate access to a key system?

Which of the following would help the internal audit activity assess compliance with the organization's standard operating procedures for bank deposits during a preliminary survey?

Which of the following would most likely form part of the engagement scope?

An internal auditor wants to determine whether the key risks identified by management in the risk register are reflective of the key risks in the industry. Which of the following techniques would the auditor apply to achieve this goal?

When auditing an organization's purchasing function, which of the following appropriately matches an engagement objective and the resulting audit procedure?

The chief audit executive (CAF) determined that the residual risk identified in an assurance engagement is acceptable. When should this be communicated to senior management?

An organization does not have a formal risk management function. According to the Standards, which of the following are conditions where the internal audit activity may provide risk management consulting?

1.There is a clear strategy and timeline to migrate risk management responsibility back to management.

2.The internal audit activity has the final approval on any risk management decisions.

3.The internal audit activity gives objective assurance on all parts of the risk management framework for which it is responsible.

4.The nature of services provided to the organization is documented in the internal audit charter.

With regard to project management, which of the following statements about project crashing is true?

An internal auditor is starting the fieldwork of an assurance engagement. The auditor will conduct a walkthrough of selected controls with control owners. What should be the primary objective of this walkthrough?

Which of the following would be the most effective fraud prevention control?

An internal auditor is planning an engagement at a financial institution. Toe engagement objective is to identify whether loans were granted in accordance with the organization's policies. When of the following approaches would provide the auditor with the best information?

According to IIA guidance, which of the following is most likely to become part of the engagement work program?

An internal auditor s testing tor proper authorization of contracts and finds that the rate of deviations discovered in the sample is equal to the tolerable deviation rate. When of the following is the most appropriate conclusion for the internal auditor to make based on this result?

A compliance engagement is underway, and management of the activity under review has asked the internal auditor to provide regular status updates and information regarding preliminary observations before the engagement is complete. Which of the following would be the internal auditor’s most appropriate response?

Which of the following is required to classify, label, organize, and search big data stored and used in an organization?

An internal auditor wants to test the processing logic of a computer application during a specific period to ensure consistent processing of transactions. Which of the following is the best approach to achieve the objective of the test?

The audit engagement objective is to identify vendors who might be involved in money laundering processes or tax evasion schemes. How would the internal auditor use data analytics to fulfill this objective?

An internal auditor is performing a review of an organization's vendor for any possible conflicts of interest. Which of the following would provide the greatest assistance to the auditor in meeting this objective?

When reviewing workpapers, engagement supervisors may ask for additional evidence or clarification via review notes. According to IIA guidance, which of the following statements is true regarding the engagement supervisors review notes?

Which of the following activities demonstrates an example of the chief audit executive performing residual risk assessment?

Acceding to IIA guidance, which of the following statements is true regarding the risk assessment process performed by the internal audit activity?

A bakery chain has a statistical model that can be used to predict daily sales at individual stores based on a direct relationship to the cost of ingredients used and an inverse relationship to rainy days. What conditions would an auditor look for as an indicator of employee theft of food from a specific store?

White planning an audit engagement of a procurement card activity. which of the following actions should an internal auditor take to denary relevant risks and controls?

Acceding to IIA guidance, when of the Mowing is an assurance service commonly performed by the internal audit activity?

The chief audit executive of an international organization is planning an audit of the treasury function located at the organization's headquarters. The current internal audit team at headquarters lacks expertise in the area of financial markets which is needed tor the engagement When of the following would be the most approbate solution considering the time constraint?

An organization owns vehicles that are kept off-site by employees to pick up and deliver orders. An internal auditor selects a specific vehicle from the fixed asset register for

testing. Which of the following would best provide sufficient, indirect evidence for the auditor to confirm the existence of the vehicle?

According to HA guidance, which of the following statements regarding audit workpapers is true?

Prior to performing testing an internal auditor has determined that a primary process control failed due to design weakness. Which of the following actions should the auditor perform next?

The audit plan requires a review of the testing procedures used in pre-production of a large information system prior to its live launch. If the chief audit executive (CAE) is uncertain that the current audit team has all the required knowledge to conduct the engagement, which of the following would be the most appropriate course of action for the CAE to take to preserve independence?

During a payroll audit, the internal auditor discovered that several individuals who have the same position classification as the are earning a significantly higher salary. The auditor noted the names and amounts of each; and he planned to prepare a request to the chief audit executive for a salary Increase based on this Information. Which of the following IIA Code of Ethics principles was violated in this scenario?

Which of the following parties is accountable for ensuring adequate support for conclusions and opinions readied by the internal audit activity while relying on external auditors' work?

During a review of the organization's waste management processes, the internal auditor discovered that wastewater is being disposed of inappropriately. The auditor's recommendations, suggested to mitigate the risk of regulatory sanctions and reputational damages, were accepted and timelines for implementation were agreed. However, during the internal audit activity's periodic follow-up exercise, management indicated that the recommendation was too expensive to implement and the current disposal method has been cost-effective. What should the chief audit executive do in this case?

While reviewing warehouse inventory records, an internal auditor noticed that the warehouse has a surprisingly high number of products in storage. Over the past three years, the auditor had visited this particular warehouse numerous times for previous engagements and remembered that the warehouse was rather small. The auditor then decided to compare the square footage of the warehouse to the recorded number of products in storage. The auditor’s action is an example of which of the following?

Which of the following is least likely to help ensure that risk is considered in a work program?

An examination of the accounts payable function evidenced multiple findings with respect to segregation of duties. After management's response and action plan are received and documented in the final report, which of the following is most appropriate?

According to IIA guidance, which of the following is least likely to be a key financial control in an organization's accounts payable process?

According to the IIA Code of Ethics, which of the following is required with regard to communicating results?

The internal audit activity (IAA) wants to measure its performance related to the quality of audit recommendations. Which of the following client survey questions would best help the IAA meet this objective?

Which of the following statements is true regarding a drawback of using internal control questionnaires (ICQs)?

An internal auditor completed a review of expenses related to the launch of a new project. The auditor sampled 45 transactions approved by a senior project manager and identified 30 with questionable vendor documentation. Which of the following is the most appropriate conclusion for the auditor to include in the audit report?

A senior internal auditor is hired within the internal audit activity for a period of two years before advancing to an operations manager role within the business operations team. When staffing arrangement is being used in this scenario?

A large retail organization, which sells most of its products online, experiences a computer hacking incident. The chief IT officer immediately investigates the incident and concludes that the attempt was not successful. The chief audit executive (CAE) learns of the attack in a casual conversation with an IT auditor. Which of the following actions should the CAE take?

1. Meet with the chief IT officer to discuss the report and control improvements that will be implemented as a result of the security breach, if any.

2. Immediately inform the chair of the audit committee of the security breach, because thus far only the chief IT officer is aware of the incident.

3. Meet with the IT auditor to develop an appropriate audit program to review the organization's Internet-based sales process and key controls.

4. Include the incident in the next quarterly report to the audit committee.

A snow removal company is conducting a scenario planning exercise where participating employees consider the potential impacts of a significant reduction in annual snowfall for the coming winter. Which of the following best describes this type of risk?

An internal auditor has discovered that duplicate payments were made to one vendor Management has recouped the duplicate payments as a corrective action Which of the following describes managements action in this case?

The internal audit activity has become aware of public complaints regarding the sales practices of telephone marketing personnel in a large organization. The internal auditors decide to review a sample of all complaints within the last three months to ensure they are reflective of current marketing practices. Which of the following best describes this sampling technique?

The board of directors expressed concerns about potential external risks that could impact the organization s ability to meet its annual objectives and goals The board requested consulting services from the internal audit activity to gain insight regarding the external risks Which of the following engagement objectives would be appropriate to fulfill this request?

Acceding to MA guidance, when of the Mowing strategies would like provide the most assurance to the chief audit executive (CAE) that the internal audit activity's recommendations are being acted upon?

Which of the following is the next step in understanding a business process once an internal auditor has identified the process?

According to IIA guidance, which of the following factors should the auditor in charge consider when determining the resource requirements for an audit engagement?

An organization invests excess short-term cash in trading securities Which of the following actions should an internal auditor take to test the valuation of those securities'*

An internal auditor wanted to determine whether the organization's 200 employees are charging their work hours accurately to the correct project. The internal auditor selected a sample of 30 employee time reports for testing. Based on the testing, the internal auditor determined the following:

- 5 Time reports were incorrect.

- 21 Time reports were correct.

- 4 Time reports were not supported.

Which of the following information is most appropriate for the chief audit executive to share when coordinating audit plans with other internal and external assurance providers?

Which of the following is not an outcome of control self-assessment?

Which of the following risk assessment approaches involves gathering data from work team representing different levels of an organisation?

Which of the following would most likely be found in an organization that uses a decentralized organizational structure?

The chief audit executive (CAE) of a small internal audit activity (IAA) plans to test conformance with the Standards through a quality assurance review. According to the Standards, which of the following are acceptable practice for this review?

1. Use an external service provider.

2. Conduct a self-assessment with independent validation.

3. Arrange for a review by qualified employees outside of the IAA.

4. Arrange for reciprocal peer review with another CAE.

An organization is experiencing a significant risk that threatens its financial well-being Senior management requested that the chief audit executive (CAE) meet with them to discuss the risk. Which of the following would best describe the CAE's responsibility at the meeting?

Which of the following is the primary weakness of internal control questionnaires (ICQs)?

An internal auditor accessed accounts payable records and extracted data related to fuel purchased tor the organization's vehicles As a first step, she sorted the data by vehicle and used spreadsheet functions to identify all instances of refueling on the same or sequential dates She then performed other tests Based on the auditor's actions which of the following is most likely the objective of this engagement1?

A chief audit executive (CAE) following up on action plans from previously completed audits identifies that management has determined that certain action plans are no longer necessary If the CAE disagrees with managements decision, which of the following is the most appropriate next step for the CAE to take?

The organization’s internal audit charter was last updated six years ago to update the charter, which of the following actions is most appropriate for the chief audit executive to take?

An engagement work program o of greatest value to audit management when which of the following is true?

Which of the following statements is true regarding engagement planning?

The internal audit function is in the fieldwork stage of the annual staff performance appraisal assurance engagement. A new auditor is hired and added to the engagement team. The auditor reviews the engagement work program with another member of the team and suggests improvements to make the fieldwork easier to complete. What action should be taken next?

A chief audit executive (CAE) determined that management chose to accept a high-level risk that may be unacceptable lo the organization. Which is the best course of action for the CAE to Follow?

Which of the following has the greatest effect on the efficiency of an audit?

A multinational organization has multiple divisions that sell their products internally to other divisions When selling internally, which of the following transfer prices would lead to the best decisions for the organization?

According to IIA guidance, which of the following would be the best first step to manage risk when a third party is overseeing the organization’s network and data'?

In which of the following situations would it be most appropriate for an internal audit function to issue an interim report or memo?

An employee in the sales department completes a purchase requisition and forwards it to the purchaser. The purchaser places competitive bids and orders the requested items using approved purchase orders. When the employee receives the ordered items, she forwards the packing slips to the accounts payable department. The invoice for the ordered items is sent directly to the sales department, and an administrative assistant in the sales department forwards the invoices to the accounts payable department for payment. Which of the following audit steps best addresses the risk of fraud in the cash receipts process?

Operational management In the IT department has developed key performance indicator reports, which are reviewed in detail during monthly staff meetings. This activity is designed to prevent which of the following conditions?

An internal auditor observes a double payment transaction on a supplier invoice during an accounts payable engagement. Which of the following steps would be the most effective in helping the auditor determine whether fraud exists?

Which of the following internal audit activities is performed in the design evaluation phase?

If observed during fieldwork by an internal auditor, which of the following activities is least important to communicate formally to the chief audit executive?

In a health care organization the internal audit activity provides overall assurance on governance, risk and control The chief audit executive advises and influences senior management, and the audit strategy leverages the organization's management of risk According to HA guidance which of the following stages of internal audit maturity best describes this organization?

An internal audit team was conducting an assurance engagement to review segregation of duties in the purchasing function. The internal auditors reviewed a sample of purchase orders from the past two year and discovered that 2 percent were signed by employees who were operating in a designated acting capacity due to employee absence. According to IIA guidance, which of the following attributes of information would most likely assist the auditor in deciding whether to report this finding?

Which of the following recommendations made by the internal audit activity (IAA) is most likely to help prevent fraud?

Management has taken immediate action to address an observation received during an audit of the organization's manufacturing process Which of the following is true regarding the validity of the observation closure?

The internal audit activity is currently working on several engagements, including a consulting engagement on the management process in the human resources department. Which of the following actions should the chief audit executive take to most efficiently and effectively ensure the quality of the engagement?

A bicycle manufacturer incurs a combination of fixed and variable costs with the production of each bicycle. Which of the following statements is true regarding these costs?

An internal auditor at a bank informed the branch manager of a malfunctioning lock on one of the vaults. The risk associated with this issue was deemed significant by the chief audit executive (CAE), and immediate remediation was recommended. However, during a follow-up engagement, the branch manager told the CAE that the risk was actually not significant, hence no action was taken. What is the most appropriate next step for the CAE?

Which of the following methodologies consists of the internal auditor holding individual meetings with different people, asking them the same questions, and aggregating the results?

An organization's healthcare insurance costs have been rising approximately 10 percent per year for several years. Which of the following analytical review procedures would best evaluate the reasonableness of the increase in healthcare costs?

Which of the following is the best audit procedure to obtain evidence of an organization's legal ownership of a new property?

Which of the following situations best applies to an organization that uses a project, rather than a process, to accomplish its business activities?

Which of the following statements about including consulting engagements in the annual internal audit plan is true?

Which of the following situations is most likely to heighten an internal auditors professional skepticism regarding potential fraud?

Internal auditors map a process by documenting the steps in the process, which provides a framework for understanding. Which of the following is a reason to use narrative memoranda?

What is the primary objective of an engagement supervisor's review of key activities performed during the engagement?

Which of the following best demonstrates internal auditors performing their work with proficiency?

Which phase of an audit engagement is typically the most effective time for an internal auditor to develop a risk and control matrix?

During the planning phase of an assurance engagement, the internal audit engagement team identifies and evaluates the inherent fraud risks within the procurement function. What should be the engagement team’s next step?

An internal auditor is planning a consuming engagement and the objective is to identify opportunities to improve the efficiency of the organization’s procurement process. The auditor is preparing to conduct a preliminary survey of the area. Which of the following approaches would be most useful to obtain relevant information to support the engagement objective?

When forming an opinion on the adequacy of management's systems of internal control, which of the following findings would provide the most reliable assurance to the chief audit executive?

• During an audit of the hiring process in a law firm, it was discovered that potential employees' credentials were not always confirmed sufficiently. This process remained unchanged at the following audit.

• During an audit of the accounts payable department, auditors calculated that two percent of accounts were paid past due. This condition persisted at a follow up audit.

• During an audit of the vehicle fleet of a rental agency, it was determined that at any given time, eight percent of the vehicles were not operational. During the next audit, this figure had increased.

• During an audit of the cash handling process in a casino, internal audit discovered control deficiencies in the transfer process between the slot machines and the cash counting area. It was corrected immediately.

According to IIA guidance, which of the following statements about analytical procedures is true?

Which of the following statements about assurance maps is correct?

According to the Standards, which of the following is true regarding the auditor's inclusion of management's satisfactory performance in the final audit report?

Which of the following is the best approach for the internal audit function to communicate moderate and high risk observations to management?

Which of the following methods is most closely associated to year over year trends?

According to HA guidance, which of the following is the Key planning step internal auditors should perform to establish appropriate engagement objectives prior to starting an audit engagement?

An internal auditor has suspicions that the management of a department splits me number of planned purchases to avoid the approval process required for larger purchases. Which of the following would be the most efficient technique to help the auditor identify the seventy of this malpractice?

Management would like to self-assess the overall effectiveness of the controls in place for its 200-person manufacturing department Which of the following client-facilitated approaches is likely to be the most efficient way to accomplish this objective?

According to IIA guidance, which of the following procedures would be least effective in managing the risk of payroll fraud?

Which of the following technologies will best reduce human processing errors and enable seamless exchange of business transactions among business partners?

While reviewing the organization’s financial year-end processes, an internal auditor discovered an erroneous journal entry. If the error is not addressed, it will result in a material misstatement of the financial records. The internal auditor needs an additional four weeks to complete the audit engagement. How should the auditor communicate this finding?

When a significant finding is noted early during a review of the accounts payable function, which next course of action is best for communicating the issue?

Senior management requested that the internal audit activity perform a consulting project to assist in making a decision on a new software system. Which of the following would be used to determine the engagement objectives?

An internal audit engagement supervisor approved the engagement work program submitted by an internal auditor and concluded that it satisfied engagement objectives. At the end of the engagement, the engagement supervisor reviewed the completed work program and found numerous deficiencies and inconsistencies in the engagement workpapers. Which of the following should be improved in the process of engagement supervision?

According to IIA guidance, which of the following objectives was most likely formulated for a non-assurance engagement?

The internal audit activity is responsible for which of the following actions related to an organization’s internal controls9

A chief audit executive (CAE) reviews the supervision of an internal audit engagement Which of the following would most likely assure the CAE that the engagement had adequate supervision?

An internal auditor submitted a report containing recommendations for management to enhance internal controls related to investments. To follow up, which of the following is the most appropriate action for the internal auditor to take?

Which of the following statistical sampling approaches is the most appropriate for testing a population for fraud?

When setting the scope for the identification and assessment of key risks and controls in a process, which of the following would be the least appropriate approach?

Which of the following describes (he primary reason why a preliminary risk assessment is conducted during engagement planning?

As part of the preliminary survey, an internal auditor sent an internal control questionnaire to the accounts payable function Based on the questionnaire responses, the auditor determines that there is no established procedure for adding and approving new vendors. What would the auditor do next?

An internal auditor discovered a control weakness that needs to be communicated to management. Which of the following is the best method for first communicating the weakness?

An auditor reviews tender results for the procurement of construction equipment. Based on her significant experience the auditor believes that the obtained bid prices are too high. Which of the following is required to develop a relevant conclusion?

Which of the following statements accurately describes the Standards requirement for ret internal audit records?

During an audit of suspense accounts the internal auditor found that there were no written policies on how suspense accounts should be treated. The auditor also found that suspense account balances were cleared once per week, not daily. Which of the following is the most appropriate first response by the auditor?

Who is responsible for ensuring internal auditors continuing professional development*

Which of the following is an effective approach for internal auditors to take to improve collaboration with audit clients during an engagement?

1. Obtain control concerns from the client before the audit begins so the internal auditor can tailor the scope accordingly.

2. Discuss the engagement plan with the client so the client can understand the reasoning behind the approach.

3. Review test criteria and procedures where the client expresses concerns about the type of tests to be conducted.

4. Provide all observations at the end of the audit to ensure the client is in agreement with the facts before publishing the report.

Which of the following is the most important determinant of the objectives and scope of assurance engagements?

In which of the following situations would an internal auditor consider the need to outsource competencies and skills9

During an operational audit of the cash receipts process, internal auditors uncovered many red flags related to possible misappropriation of cash and other cash-flow problems indicative of potential employee fraud. Which of the following statements is true regarding the follow-up investigative audit?

Which of the following processes does the board manage to ensure adequate governance?

The internal auditors available to perform the engagement do not have sufficient skills related to the area under review. Which of the following iss an appropriate action for the chief audit executive to take?

Following an audit, management developed an action plan to improve controls over the handling of scrap metal. Which of the following would be the most appropriate course of action for the auditor to follow up?

Which of the following resources would be most effective for an organization that would like to improve how it informs stakeholders of its social responsibility performance?

An internal auditor conducted interviews with several employees, documented the interviews analyzed the summaries, and drew a number of conclusions. What sort of audit evidence has the internal auditor primarily obtained?

Which of the following offers the best explanation of why the auditor in charge would assign a junior auditor to complete a complex part of the audit engagement?

New environmental regulations require the board to certify that the organization's reported pollutant emissions data is accurate. The chief audit executive (CAE) is planning an audit to provide assurance over the organization's compliance with the environmental regulations. Which of the following groups or individuals is most important for the CAE to consult to determine the scope of the audit?

Which of the following sources of testimonial evidence would be considered the most reliable regarding whether a process is effectively performed according to its design?

Which of the following is more likely to be present in a highly centralized organization?

Which of the following would be most likely found in an internal audit procedures manual?

An internal auditor is conducting an initial risk assessment of an audit area and wants to assess management's compliance with privacy laws for safeguarding customer information stored on the organization's servers. Which course of action is appropriate for this phase of the engagement?

The final engagement communication contains the following observation:

The internal auditor discovered that three of the 10 contracts reviewed failed to meet the organization's competitive bidding requirements Management explained that senior management deemed these purchases to be critical and awarded them as sole-source."

Which of the following components is missing in the documentation of the observation?

Which of the following is an example of a properly supervised engagement?

An engagement team is being assembled to audit of one of the organization's vendors Which of the following statements best applies to this scenario?